Dollar Tree 2006 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2006 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

46 DOLLAR TREE STORES, INC. • 2006 ANNUAL REPORT

The intrinsic value of options exercised during

2006, 2005 and 2004 was approximately $13.1

million, $2.8 million and $5.7 million, respectively.

Restricted Stock

The Company granted 277,347 and 252,936 RSUs,

net of forfeitures in 2006 and 2005, respectively, from

the EIP and the EOEP to the Company’s employees

and officers. The fair value of all of these RSUs of

$13.9 million is being expensed ratably over the

three-year vesting periods, or a shorter period based

on the retirement eligibility of the grantee. The fair

value was determined using the Company’s closing

stock price on the date of grant. The Company recog-

nized $4.5 million of expense related to the RSUs dur-

ing 2006. As of February 3, 2007, there was approxi-

mately $7.8 million of total unrecognized compensa-

tion expense related to these RSUs which is expected

to be recognized over a weighted average period of

24 months. In 2005, the Company recognized

approximately $1.6 million of expense for the RSUs

granted in 2005.

In 2005, the Company granted 40,000 RSUs

from the EOEP to certain officers of the Company,

contingent on the Company meeting certain perform-

ance targets in 2005 and future service of these offi-

cers through various points through July 2007. The

Company met these performance targets in fiscal

2005; therefore, the fair value of these RSUs of $1.0

million is being expensed over the service period. The

fair value of these RSUs was determined using the

Company’s closing stock price January 28, 2006 (the

last day of fiscal 2005), when the performance targets

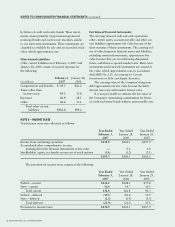

Options Outstanding Options Exercisable

Options Options

Outstanding Weighted Avg. Weighted Avg. Exercisable Weighted Avg.

Range of at February 3, Remaining Exercise at February 3, Exercise

Exercise Prices 2007 Contractual Life Price 2007 Price

$0.86 7,264 N/A 0.86 7,264 0.86

$2.95 to $10.98 7,174 0.1 9.93 7,174 9.93

$10.99 to $21.28 777,807 5.1 19.18 777,807 19.18

$21.29 to $29.79 2,511,244 5.8 25.26 2,172,077 24.90

$29.80 to $42.56 1,162,552 5.0 32.26 1,162,552 32.26

$0.86 to $42.56 4,466,041 4,126,874

were satisfied. The Company recognized $0.3 million

of expense related to these RSUs in 2006. The

remaining $0.1 million will be recognized over the

vesting periods through July 2007. In 2005, the

Company recognized $0.7 million of expense for

these RSUs.

In 2006, the Company granted 6,000 RSUs

from the EOEP and the EIP to certain officers of the

Company, contingent on the Company meeting cer-

tain performance targets in 2006 and future service of

the these officers through fiscal 2006. The Company

met these performance targets in fiscal 2006; there-

fore, the Company recognized the fair value of these

RSUs of $0.2 million during fiscal 2006. The fair

value of these RSUs was determined using the

Company’s closing stock price on the grant date in

accordance with SFAS 123R.

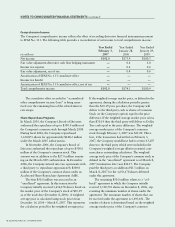

The following table summarizes the status of

RSUs as of February 3, 2007, and changes during the

53 weeks then ended:

Weighted

Average

Grant

Date Fair

Shares Value

Nonvested at

January 28, 2006 295,507 $25.00

Granted 292,697 27.69

Vested (106,547) 25.08

Forfeited (24,880) 26.63

Nonvested at

February 3, 2007 456,777 $26.57