Dollar Tree 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

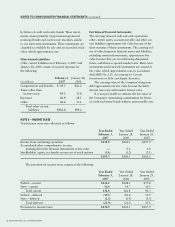

NOTE 3 – INCOME TAXES

Total income taxes were allocated as follows:

Year Ended Year Ended Year Ended

February 3, January 28, January 29,

2007 2006 2005

Income from continuing operations $110.9 $101.3 $107.9

Accumulated other comprehensive income,

marking derivative financial instruments to fair value —0.2 0.4

Stockholders’ equity, tax benefit on exercise of stock options (5.6) (1.2) (2.1)

$105.3 $100.3 $106.2

The provision for income taxes consists of the following:

Year Ended Year Ended Year Ended

February 3, January 28, January 29,

2007 2006 2005

Federal – current $116.2 $108.1 $75.8

State – current 16.6 14.7 16.5

Total current 132.8 122.8 92.3

Federal – deferred (19.1) (20.6) 15.9

State – deferred (2.8) (0.9) (0.3)

Total deferred (21.9) (21.5) 15.6

Provision for income taxes $110.9 $101.3 $107.9

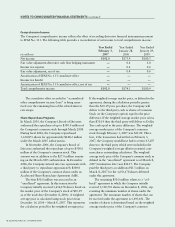

by letters of credit and surety bonds. These invest-

ments consist primarily of government-sponsored

municipal bonds and auction rate securities, similar

to our short-term investments. These investments are

classified as available for sale and are recorded at fair

value, which approximates cost.

Other Current Liabilities

Other current liabilities as of February 3, 2007 and

January 28, 2006 consist of accrued expenses for

the following:

February 3, January 28,

(in millions) 2007 2006

Compensation and benefits $ 43.5 $22.2

Taxes (other than

income taxes) 19.5 15.8

Insurance 26.8 28.1

Other 42.2 33.1

Total other current

liabilities $132.0 $99.2

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

Fair Value of Financial Instruments

The carrying values of cash and cash equivalents,

other current assets, accounts payable and other cur-

rent liabilities approximate fair value because of the

short maturity of these instruments. The carrying val-

ues of other long-term financial assets and liabilities,

excluding restricted investments, approximate fair

value because they are recorded using discounted

future cash flows or quoted market rates. Short-term

investments and restricted investments are carried at

fair value, which approximates cost, in accordance

with SFAS No. 115, Accounting for Certain

Investments in Debt and Equity Securities.

The carrying value of the Company’s long-term

debt approximates its fair value because the debt’s

interest rates vary with market interest rates.

It is not practicable to estimate the fair value of

the Company’s outstanding commitments for letters

of credit and surety bonds without unreasonable cost.

36 DOLLAR TREE STORES, INC. • 2006 ANNUAL REPORT