Dollar Tree 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR TREE STORES, INC. • 2006 ANNUAL REPORT 43

stock during the same calculation period as defined in

the “uncollared” agreement. The weighted average

market price through February 3, 2007 as defined in

the “collared” agreement was $30.80. Therefore, if

the transaction had settled on February 3, 2007, the

Company would have received an additional 122,742

shares under the “collared” agreement. Based on the

applicable accounting literature, these additional

shares were not included in the weighted average

diluted earnings per share calculation because their

effect would be anti-dilutive. Based on the weighted

average price as of February 3, 2007 of $30.80, there

is approximately $3.8 million of the $50.0 million

related to the “collared” agreement that is recorded

as a reduction to stockholders’ equity pending final

settlement of the agreement. The weighted average

stock price of the Company’s common stock as

defined in the “collared” agreement as of March 8,

2007 (termination date) was $31.97. The Company

received an additional 63,525 shares on March 8,

2007 under this agreement.

NOTE 8 – EMPLOYEE BENEFIT PLANS

Profit Sharing and 401(k) Retirement Plan

The Company maintains a defined contribution profit

sharing and 401(k) plan which is available to all

employees over 21 years of age who have completed

one year of service in which they have worked at least

1,000 hours. Eligible employees may make elective

salary deferrals. The Company may make contribu-

tions at its discretion.

Contributions to and reimbursements by the

Company of expenses of the plan included in the

accompanying consolidated statements of operations

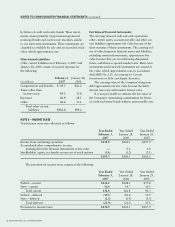

were as follows:

Year Ended February 3, 2007 $16.8 million

Year Ended January 28, 2006 6.9 million

Year Ended January 29, 2005 8.5 million

Eligible employees hired prior to January 1, 2007

are immediately vested in the Company’s profit shar-

ing contributions. Eligible employees hired subsequent

to January 1, 2007 vest in the Company’s profit shar-

ing contributions based on the following schedule:

• 25% after three years of service

• 50% after four years of service

• 100% after five years of service

All eligible employees are immediately vested in

any Company match contributions under the 401(k)

portion of the plan.

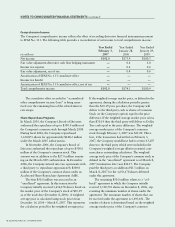

Deferred Compensation Plan

The Company has a deferred compensation plan

which provides certain officers and executives the

ability to defer a portion of their base compensation

and bonuses and invest their deferred amounts. The

plan is a nonqualified plan and the Company may

make discretionary contributions. The deferred

amounts and earnings thereon are payable to partici-

pants, or designated beneficiaries, at specified future

dates, or upon retirement or death. Total cumulative

participant deferrals were approximately $2.3 million

and $2.0 million, respectively, at February 3, 2007

and January 28, 2006 and are included in “other lia-

bilities” on the accompanying consolidated balance

sheets. The related assets are included in “other

assets, net” on the accompanying consolidated bal-

ance sheets. The Company made no discretionary

contributions in the years ended February 3, 2007,

January 28, 2006 and January 29, 2005.

NOTE 9 – STOCK-BASED COMPENSATION PLANS

At February 3, 2007, the Company has eight stock-

based compensation plans. Each plan and the

accounting method are described below.

Fixed Stock Option Compensation Plans

Under the Non-Qualified Stock Option Plan (SOP),

the Company granted options to its employees for

1,047,264 shares of Common Stock in 1993 and

1,048,289 shares in 1994. Options granted under

the SOP have an exercise price of $0.86 and are fully

vested at the date of grant.

Under the 1995 Stock Incentive Plan (SIP), the

Company granted options to its employees for the

purchase of up to 12.6 million shares of Common

Stock. The exercise price of each option equaled the

market price of the Company’s stock at the date of