Cisco 2014 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2014 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

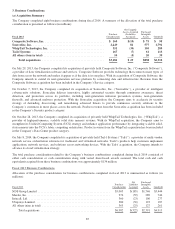

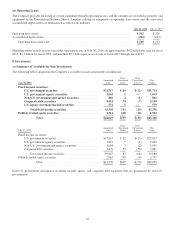

3. Business Combinations

(a) Acquisition Summary

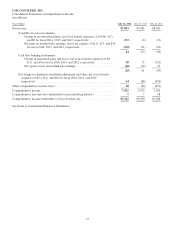

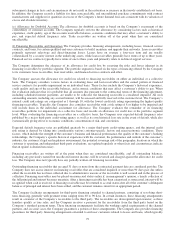

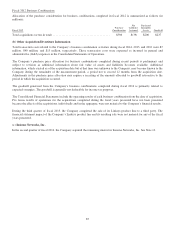

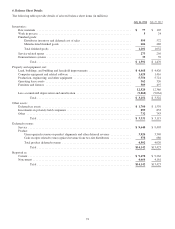

The Company completed eight business combinations during fiscal 2014. A summary of the allocation of the total purchase

consideration is presented as follows (in millions):

Fiscal 2014

Purchase

Consideration

Net Tangible

Assets Acquired

(Liabilities

Assumed)

Purchased

Intangible

Assets Goodwill

Composite Software, Inc. ........................................ $ 160 $(10) $ 75 $ 95

Sourcefire, Inc. ................................................ 2,449 81 577 1,791

WhipTail Technologies, Inc. ..................................... 351 (34) 105 280

Tail-f Systems ................................................. 167 (7) 61 113

All others (four in total) ......................................... 54 (5) 20 39

Total acquisitions .......................................... $3,181 $ 25 $838 $2,318

On July 29, 2013, the Company completed its acquisition of privately held Composite Software, Inc. (“Composite Software”),

a provider of data virtualization software and services. Composite Software provides technology that connects many types of

data from across the network and makes it appear as if the data is in one place. With its acquisition of Composite Software, the

Company intends to extend its next-generation services platform by connecting data and infrastructure. Revenue from the

Composite Software acquisition has been included in the Company’s Service category.

On October 7, 2013, the Company completed its acquisition of Sourcefire, Inc. (“Sourcefire”), a provider of intelligent

cybersecurity solutions. Sourcefire delivers innovative, highly automated security through continuous awareness, threat

detection, and protection across its portfolio, including next-generation intrusion prevention systems, next-generation

firewalls, and advanced malware protection. With the Sourcefire acquisition, the Company aims to accelerate its security

strategy of defending, discovering, and remediating advanced threats to provide continuous security solutions to the

Company’s customers in more places across the network. Product revenue from the Sourcefire acquisition has been included

in the Company’s Security product category.

On October 28, 2013, the Company completed its acquisition of privately held WhipTail Technologies, Inc. (“WhipTail”), a

provider of high-performance, scalable solid state memory systems. With its WhipTail acquisition, the Company aims to

strengthen its Unified Computing System (UCS) strategy and enhance application performance by integrating scalable solid-

state memory into the UCS’s fabric computing architecture. Product revenue from the WhipTail acquisition has been included

in the Company’s Data Center product category.

On July 8, 2014, the Company completed its acquisition of privately held Tail-f Systems (“Tail-f”), a provider of multi-vendor

network service orchestration solutions for traditional and virtualized networks. Tail-f’s products help customers implement

applications, network services, and solutions across networking devices. With the Tail-f acquisition, the Company intends to

advance its cloud virtualization strategy.

The total purchase consideration related to the Company’s business combinations completed during fiscal 2014 consisted of

either cash consideration or cash consideration along with vested share-based awards assumed. The total cash and cash

equivalents acquired from these business combinations was approximately $134 million.

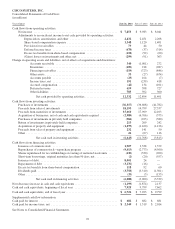

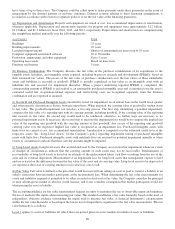

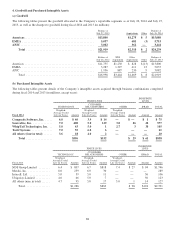

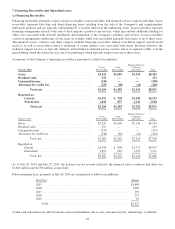

Fiscal 2013 Business Combinations

Allocation of the purchase consideration for business combinations completed in fiscal 2013 is summarized as follows (in

millions):

Fiscal 2013

Purchase

Consideration

Net

Liabilities

Assumed

Purchased

Intangible

Assets Goodwill

NDS Group Limited ................................................. $5,005 $(185) $1,746 $3,444

Meraki, Inc. ........................................................ 974 (59) 289 744

Intucell, Ltd. ....................................................... 360 (23) 106 277

Ubiquisys Limited ................................................... 280 (30) 123 187

All others (nine in total) .............................................. 363 (25) 127 261

Total acquisitions ............................................... $6,982 $(322) $2,391 $4,913

85