Cisco 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

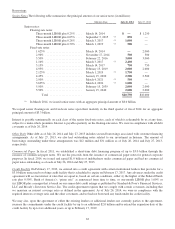

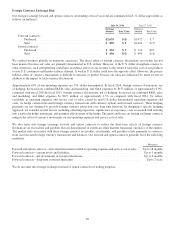

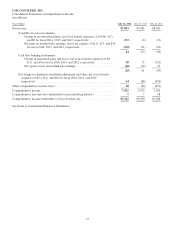

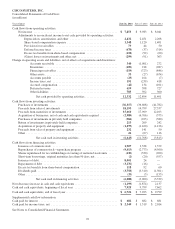

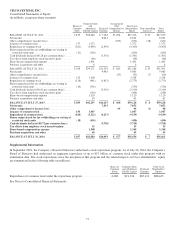

Foreign Currency Exchange Risk

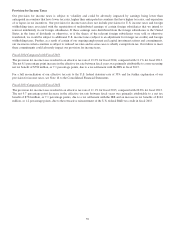

Our foreign exchange forward and option contracts outstanding at fiscal year-end are summarized in U.S. dollar equivalents as

follows (in millions):

July 26, 2014 July 27, 2013

Notional

Amount Fair Value

Notional

Amount Fair Value

Forward contracts:

Purchased ........................................... $2,635 $(3) $3,472 $ 7

Sold ................................................ $ 896 $ 2 $1,401 $ (5)

Option contracts:

Purchased ........................................... $ 494 $ 5 $ 716 $23

Sold ................................................ $ 466 $(2) $ 696 $ (4)

We conduct business globally in numerous currencies. The direct effect of foreign currency fluctuations on revenue has not

been material because our sales are primarily denominated in U.S. dollars. However, if the U.S. dollar strengthens relative to

other currencies, such strengthening could have an indirect effect on our revenue to the extent it raises the cost of our products

to non-U.S. customers and thereby reduces demand. A weaker U.S. dollar could have the opposite effect. However, the precise

indirect effect of currency fluctuations is difficult to measure or predict because our sales are influenced by many factors in

addition to the impact of such currency fluctuations.

Approximately 65% of our operating expenses are U.S.-dollar denominated. In fiscal 2014, foreign currency fluctuations, net

of hedging, decreased our combined R&D, sales and marketing, and G&A expenses by $153 million, or approximately 0.9%,

compared with fiscal 2013.In fiscal 2013, foreign currency fluctuations, net of hedging, decreased our combined R&D, sales

and marketing, and G&A expenses by $227 million, or approximately 1.3% as compared with fiscal 2012. To reduce

variability in operating expenses and service cost of sales caused by non-U.S.-dollar denominated operating expenses and

costs, we hedge certain forecasted foreign currency transactions with currency options and forward contracts. These hedging

programs are not designed to provide foreign currency protection over long time horizons. In designing a specific hedging

approach, we consider several factors, including offsetting exposures, significance of exposures, costs associated with entering

into a particular hedge instrument, and potential effectiveness of the hedge. The gains and losses on foreign exchange contracts

mitigate the effect of currency movements on our operating expenses and service cost of sales.

We also enter into foreign exchange forward and option contracts to reduce the short-term effects of foreign currency

fluctuations on receivables and payables that are denominated in currencies other than the functional currencies of the entities.

The market risks associated with these foreign currency receivables, investments, and payables relate primarily to variances

from our forecasted foreign currency transactions and balances. Our forward and option contracts generally have the following

maturities:

Maturities

Forward and option contracts—forecasted transactions related to operating expenses and service cost of sales . . Up to 18 months

Forward contracts—current assets and liabilities ............................................... Upto3months

Forward contracts—net investments in foreign subsidiaries ....................................... Upto6months

Forward contracts—long-term customer financings ............................................. Upto2years

We do not enter into foreign exchange forward or option contracts for trading purposes.

69