Cisco 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

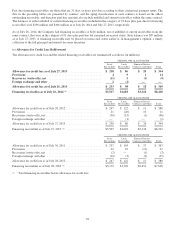

As of July 26, 2014, for fixed income securities that were in unrealized loss positions, the Company has determined that (i) it

does not have the intent to sell any of these investments, and (ii) it is not more likely than not that it will be required to sell any

of these investments before recovery of the entire amortized cost basis. In addition, as of July 26, 2014, the Company

anticipates that it will recover the entire amortized cost basis of such fixed income securities and has determined that no other-

than-temporary impairments associated with credit losses were required to be recognized during the year ended July 26, 2014.

The Company has evaluated its publicly traded equity securities as of July 26, 2014 and has determined that there was no

indication of other-than-temporary impairments in the respective categories of unrealized losses. This determination was based

on several factors, which include the length of time and extent to which fair value has been less than the cost basis, the

financial condition and near-term prospects of the issuer, and the Company’s intent and ability to hold the publicly traded

equity securities for a period of time sufficient to allow for any anticipated recovery in market value.

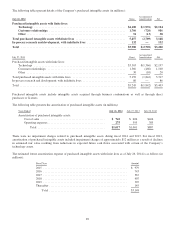

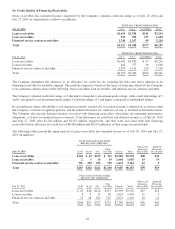

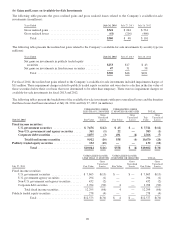

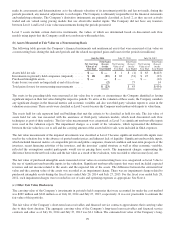

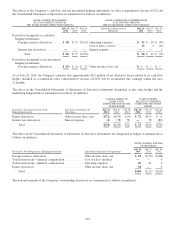

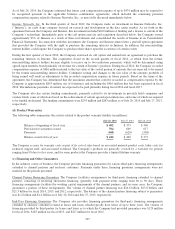

(c) Maturities of Fixed Income Securities

The following table summarizes the maturities of the Company’s fixed income securities at July 26, 2014 (in millions):

Amortized Cost Fair Value

Less than 1 year ................................................................... $15,444 $15,457

Due in 1 to 2 years ................................................................. 13,449 13,484

Due in 2 to 5 years ................................................................. 13,711 13,743

Due after 5 years ................................................................... 701 712

Total ........................................................................ $43,305 $43,396

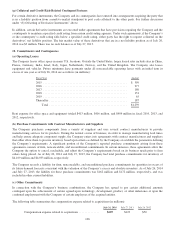

Actual maturities may differ from the contractual maturities because borrowers may have the right to call or prepay certain

obligations. The remaining contractual principal maturities for mortgage-backed securities were allocated assuming no

prepayments.

(d) Securities Lending

The Company periodically engages in securities lending activities with certain of its available-for-sale investments. These

transactions are accounted for as a secured lending of the securities, and the securities are typically loaned only on an

overnight basis. The average daily balance of securities lending for fiscal 2014 and 2013 was $1.5 billion and $0.7 billion,

respectively. The Company requires collateral equal to at least 102% of the fair market value of the loaned security and that

the collateral be in the form of cash or liquid, high-quality assets. The Company engages in these secured lending transactions

only with highly creditworthy counterparties, and the associated portfolio custodian has agreed to indemnify the Company

against collateral losses. The Company did not experience any losses in connection with the secured lending of securities

during the periods presented. As of July 26, 2014 and July 27, 2013, the Company had no outstanding securities lending

transactions.

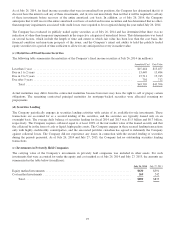

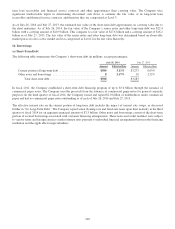

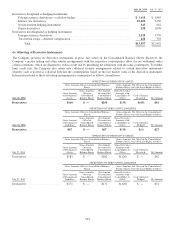

(e) Investments in Privately Held Companies

The carrying value of the Company’s investments in privately held companies was included in other assets. For such

investments that were accounted for under the equity and cost method as of July 26, 2014 and July 27, 2013, the amounts are

summarized in the table below (in millions):

July 26, 2014 July 27, 2013

Equity method investments .......................................................... $630 $591

Cost method investments ............................................................ 269 242

Total ........................................................................ $899 $833

97