Cisco 2014 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2014 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

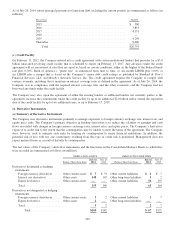

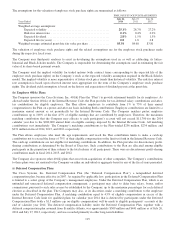

(g) Collateral and Credit-Risk-Related Contingent Features

For certain derivative instruments, the Company and its counterparties have entered into arrangements requiring the party that

is in a liability position from a mark-to-market standpoint to post cash collateral to the other party. See further discussion

under “(b) Offsetting of Derivative Instruments” above.

In addition, certain derivative instruments are executed under agreements that have provisions requiring the Company and the

counterparty to maintain a specified credit rating from certain credit-rating agencies. Under such agreements, if the Company’s

or the counterparty’s credit rating falls below a specified credit rating, either party has the right to request collateral on the

derivatives’ net liability position. The fair market value of these derivatives that are in a net liability position as of July 26,

2014 was $3 million. There was no such balance as of July 27, 2013.

12. Commitments and Contingencies

(a) Operating Leases

The Company leases office space in many U.S. locations. Outside the United States, larger leased sites include sites in China,

France, Germany, India, Israel, Italy, Japan, Netherlands, Norway, and the United Kingdom. The Company also leases

equipment and vehicles. Future minimum lease payments under all noncancelable operating leases with an initial term in

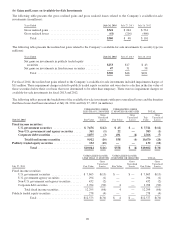

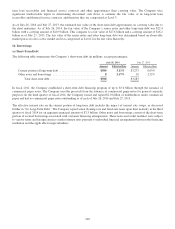

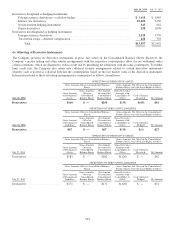

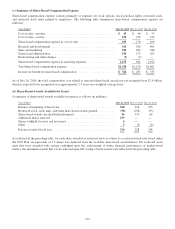

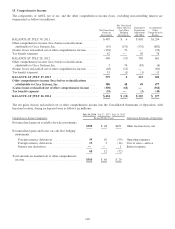

excess of one year as of July 26, 2014 are as follows (in millions):

Fiscal Year Amount

2015 ......................................................... $ 399

2016 ......................................................... 277

2017 ......................................................... 180

2018 ......................................................... 131

2019 ......................................................... 65

Thereafter ..................................................... 187

Total ..................................................... $1,239

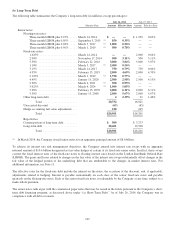

Rent expense for office space and equipment totaled $413 million, $416 million, and $404 million in fiscal 2014, 2013, and

2012, respectively.

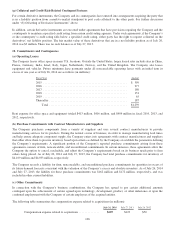

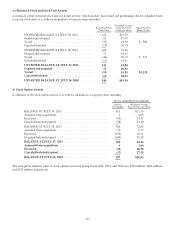

(b) Purchase Commitments with Contract Manufacturers and Suppliers

The Company purchases components from a variety of suppliers and uses several contract manufacturers to provide

manufacturing services for its products. During the normal course of business, in order to manage manufacturing lead times

and help ensure adequate component supply, the Company enters into agreements with contract manufacturers and suppliers

that either allow them to procure inventory based upon criteria as defined by the Company or establish the parameters defining

the Company’s requirements. A significant portion of the Company’s reported purchase commitments arising from these

agreements consists of firm, noncancelable, and unconditional commitments. In certain instances, these agreements allow the

Company the option to cancel, reschedule, and adjust the Company’s requirements based on its business needs prior to firm

orders being placed. As of July 26, 2014 and July 27, 2013, the Company had total purchase commitments for inventory of

$4,169 million and $4,033 million, respectively.

The Company records a liability for firm, noncancelable, and unconditional purchase commitments for quantities in excess of

its future demand forecasts consistent with the valuation of the Company’s excess and obsolete inventory. As of July 26, 2014

and July 27, 2013, the liability for these purchase commitments was $162 million and $172 million, respectively, and was

included in other current liabilities.

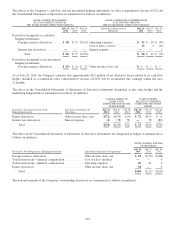

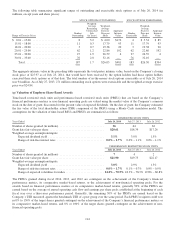

(c) Other Commitments

In connection with the Company’s business combinations, the Company has agreed to pay certain additional amounts

contingent upon the achievement of certain agreed-upon technology, development, product, or other milestones or upon the

continued employment with the Company of certain employees of the acquired entities.

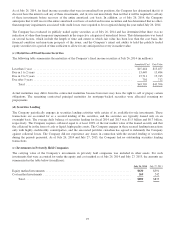

The following table summarizes the compensation expense related to acquisitions (in millions):

July 26, 2014 July 27, 2013 July 28, 2012

Compensation expense related to acquisitions .............. $607 $123 $50

106