Cisco 2014 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2014 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

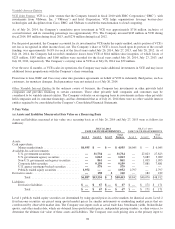

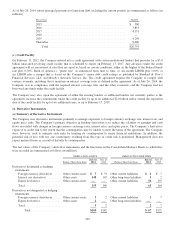

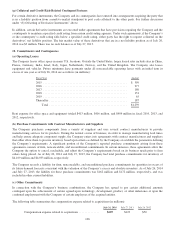

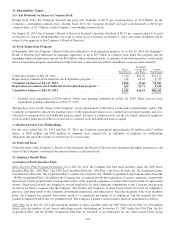

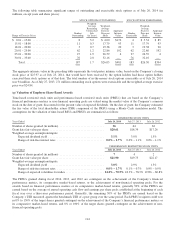

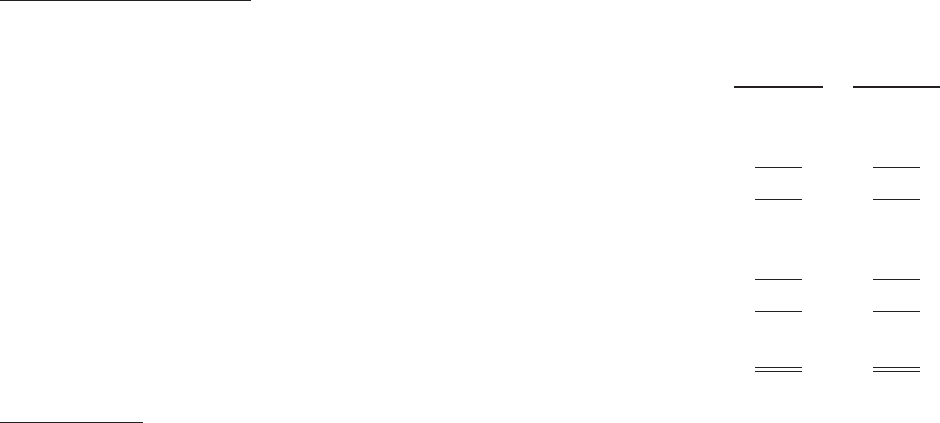

Financing Guarantee Summary The aggregate amounts of financing guarantees outstanding at July 26, 2014 and July 27, 2013,

representing the total maximum potential future payments under financing arrangements with third parties along with the

related deferred revenue, are summarized in the following table (in millions):

July 26, 2014 July 27, 2013

Maximum potential future payments relating to financing guarantees:

Channel partner ............................................. $ 263 $ 438

End user ................................................... 202 237

Total .................................................. $ 465 $ 675

Deferred revenue associated with financing guarantees:

Channel partner ............................................. $(127) $(225)

End user ................................................... (166) (191)

Total .................................................. $(293) $(416)

Maximum potential future payments relating to financing guarantees, net of

associated deferred revenue ...................................... $ 172 $ 259

Other Guarantees The Company’s other guarantee arrangements as of July 26, 2014 and July 27, 2013 that were subject to

recognition and disclosure requirements were not material.

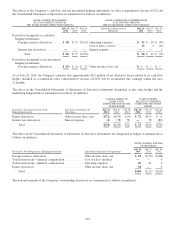

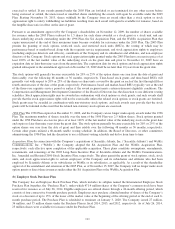

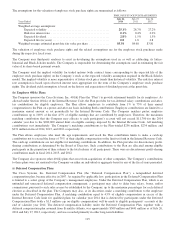

(f) Supplier Component Remediation Liability

The Company has recorded in other current liabilities a liability for the expected remediation cost for certain products sold in

prior fiscal years containing memory components manufactured by a single supplier between 2005 and 2010. These

components are widely used across the industry and are included in a number of the Company’s products. Defects in some of

these components have caused products to fail after a power cycle event. Defect rates due to this issue have been and are

expected to be low. However, recently the Company has seen a small number of its customers experience a growing number of

failures in their networks as a result of this component problem. Although the majority of these products are beyond the

Company’s warranty terms, the Company is proactively working with customers on mitigation. Prior to the second quarter of

fiscal 2014, the Company had a liability of $63 million related to this issue for expected remediation costs based on the

intended approach at that time. In February 2014, on the basis of the growing number of failures described above, the

Company decided to expand its approach, which resulted in an additional charge to product cost of sales of $655 million being

recorded for the second quarter of fiscal 2014. As of July 26, 2014, the remaining supplier component remediation liability

was $670 million.

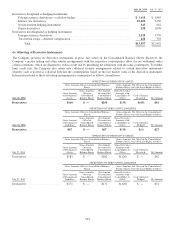

(g) Indemnifications

In the normal course of business, the Company indemnifies other parties, including customers, lessors, and parties to other

transactions with the Company, with respect to certain matters. The Company has agreed to hold such parties harmless against

losses arising from a breach of representations or covenants or out of intellectual property infringement or other claims made

against certain parties. These agreements may limit the time within which an indemnification claim can be made and the

amount of the claim.

The Company has an obligation to indemnify certain expenses pursuant to such agreements in a case involving certain of the

Company’s service provider customers that are subject to patent infringement claims asserted by Sprint Communications

Company, L.P. (“Sprint”) in the United States District Court for the District of Kansas filed on December 19, 2011 (including

one case that was later transferred to the District of Delaware). Sprint alleges that the service providers infringe Sprint’s

patents by offering Voice over Internet Protocol-based telephone services utilizing products provided by the Company and

other manufacturers. Sprint is seeking monetary damages. Trial dates have been set for the first half of calendar year 2015.

The parties intend to conduct a mediation later this calendar year, and the Company may be asked to participate. The

mediation could result in a resolution of the case for some or all of the Company’s service provider customers. The Company

believes that the service providers have strong defenses and that its products do not infringe the patents subject to the claims.

Due to the uncertainty surrounding the litigation process, which involves numerous defendants, the Company is unable to

reasonably estimate the ultimate outcome of this litigation at this time. Should the plaintiff prevail in litigation, mediation, or

settlement, the Company may have an obligation to indemnify its service provider customers for damages, mediation awards,

or settlement amounts arising from their use of Cisco products.

In addition, the Company has entered into indemnification agreements with its officers and directors, and the Company’s

Amended and Restated Bylaws contain similar indemnification obligations to the Company’s agents.

108