Cisco 2014 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2014 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

It is not possible to determine the maximum potential amount under these indemnification agreements due to the Company’s

limited history with prior indemnification claims and the unique facts and circumstances involved in each particular

agreement. Historically, payments made by the Company under these agreements have not had a material effect on the

Company’s operating results, financial position, or cash flows.

(h) Legal Proceedings

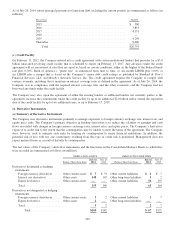

Brazil Brazilian authorities have investigated the Company’s Brazilian subsidiary and certain of its current and former

employees, as well as a Brazilian importer of the Company’s products, and its affiliates and employees, relating to alleged

evasion of import taxes and alleged improper transactions involving the subsidiary and the importer. Brazilian tax authorities

have assessed claims against the Company’s Brazilian subsidiary based on a theory of joint liability with the Brazilian

importer for import taxes, interest, and penalties. In addition to claims asserted by the Brazilian federal tax authorities in prior

fiscal years, tax authorities from the Brazilian state of Sao Paulo have asserted similar claims on the same legal basis in prior

fiscal years. In the first quarter of fiscal 2013, the Brazilian federal tax authorities asserted an additional claim against the

Company’s Brazilian subsidiary based on a theory of joint liability with respect to an alleged underpayment of income taxes,

social taxes, interest, and penalties by a Brazilian distributor.

The asserted claims by Brazilian federal tax authorities are for calendar years 2003 through 2008, and the asserted claims by

the tax authorities from the state of Sao Paulo are for calendar years 2005 through 2007. The total asserted claims by Brazilian

state and federal tax authorities aggregate to approximately $389 million for the alleged evasion of import and other taxes,

approximately $1.3 billion for interest, and approximately $1.7 billion for various penalties, all determined using an exchange

rate as of July 26, 2014. The Company has completed a thorough review of the matters and believes the asserted claims against

the Company’s Brazilian subsidiary are without merit, and the Company is defending the claims vigorously. While the

Company believes there is no legal basis for the alleged liability, due to the complexities and uncertainty surrounding the

judicial process in Brazil and the nature of the claims asserting joint liability with the importer, the Company is unable to

determine the likelihood of an unfavorable outcome against its Brazilian subsidiary and is unable to reasonably estimate a

range of loss, if any. The Company does not expect a final judicial determination for several years.

Russia and the Commonwealth of Independent States At the request of the U.S. Securities and Exchange Commission (SEC)

and the U.S. Department of Justice, the Company is conducting an investigation into allegations which the Company and those

agencies received regarding possible violations of the U.S. Foreign Corrupt Practices Act involving business activities of the

Company’s operations in Russia and certain of the Commonwealth of Independent States, and by certain resellers of the

Company’s products in those countries. The Company takes any such allegations very seriously and is fully cooperating with

and sharing the results of its investigation with the SEC and the Department of Justice. While the outcome of the Company’s

investigation is currently not determinable, the Company does not expect that it will have a material adverse effect on its

consolidated financial position, results of operations, or cash flows. The countries that are the subject of the investigation

collectively comprise less than 2% of the Company’s revenues.

Rockstar The Company and some of its service provider customers are subject to patent claims asserted in December 2013 in

the Eastern District of Texas and the District of Delaware by subsidiaries of the Rockstar Consortium (“Rockstar”). Rockstar,

whose members include Apple, Microsoft, LM Ericsson, Sony, and Blackberry, purchased a portfolio of patents out of the

Nortel Networks’ bankruptcy proceedings (the “Nortel Portfolio”). Rockstar’s subsidiaries allege that some of the Company’s

NGN Routing, Switching and Collaboration products, as well as video solutions deployed by its service provider customers,

infringe some of the patents in the Nortel Portfolio. Rockstar seeks monetary damages. A trial date for one service provider

customer has been set for October 2015; no other trial dates have been set. The Company has various defenses to the patent

infringement allegations, and has various offensive claims against Rockstar and some of its consortium members available to it

as well, and the Company will also explore alternative means of resolution. Due to the uncertainty surrounding the litigation

process, which involves numerous lawsuits and parties, the Company is unable to reasonably estimate the ultimate outcome

and a range of loss, if any, of these litigations at this time.

In addition, the Company is subject to legal proceedings, claims, and litigation arising in the ordinary course of business,

including intellectual property litigation. While the outcome of these matters is currently not determinable, the Company does

not expect that the ultimate costs to resolve these matters will have a material adverse effect on its consolidated financial

position, results of operations, or cash flows.

109