Cincinnati Bell 2014 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2014 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Form 10-K Part II

Cincinnati Bell Inc.

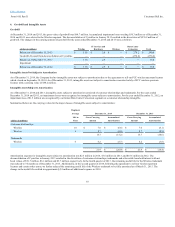

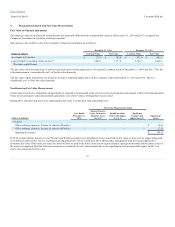

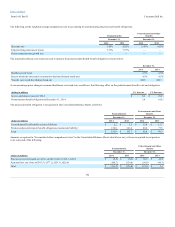

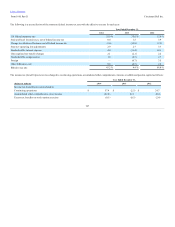

The carrying values of our financial instruments do not materially differ from the estimated fair values as of December 31, 2014 and 2013, except for the

Company's investment in CyrusOne and long-term debt.

The carrying value and fair value of the Company’s financial instruments are as follows:

Investment in CyrusOne $ 273.6

$ 785.0

$ 471.0

$ 993.2

Long-term debt, including current portion* 1,686.1

1,717.4

2,162.7

2,248.3

*Excludes capital leases.

The fair value of our investment in CyrusOne was based on the closing market price of CyrusOne's common stock on December 31, 2014 and 2013. This fair

value measurement is considered Level 1 of the fair value hierarchy.

The fair value of debt instruments was based on closing or estimated market prices of the Company’s debt at December 31, 2014 and 2013, which is

considered Level 2 of the fair value hierarchy.

Certain long-lived assets, intangibles, and goodwill are required to be measured at fair value on a non-recurring basis subsequent to their initial measurement.

These non-recurring fair value measurements generally occur when evidence of impairment has occurred.

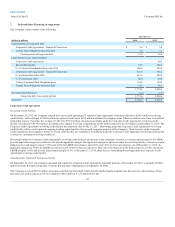

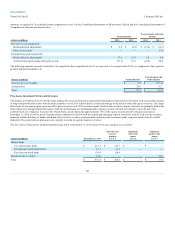

During 2014, the following assets were remeasured at fair value in connection with impairment tests:

Property:

Office software, furniture, fixtures, & vehicles (Wireline) —

—

—

—

$ (4.6)

Office software, furniture, fixtures, & vehicles (Wireless) —

—

—

—

(7.5)

Impairment of assets

$ (12.1)

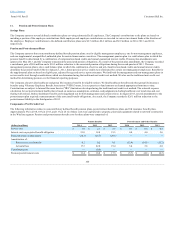

In 2014, certain software projects on our Wireline and Wireless segments were abandoned. These assets had no fair value, as they were no longer being used

or would not be placed into service, resulting in an impairment loss of $12.1 million in 2014. Historically, management used the income approach to

determine fair value of the assets, but since the assets will not be used in the future, there are no expected future earnings attributable and the entire value of

the assets was impaired. This fair value measurement is considered a Level 3 measurement due to the significance of its unobservable inputs. In 2013, no

assets were remeasured at fair value.

97