Cincinnati Bell 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Form 10-K Part II

Cincinnati Bell Inc.

Management reviews the carrying value of property, plant and equipment and other long-lived assets, including intangible assets with

definite lives, when events or changes in circumstances indicate that the carrying amount of the assets may not be recoverable. An impairment loss is

recognized when the estimated future undiscounted cash flows expected to result from the use of an asset (or group of assets) and its eventual disposition is

less than its carrying amount. An impairment loss is measured as the amount by which the asset’s carrying value exceeds its estimated fair value. Long-lived

intangible assets are amortized based on the estimated economic value generated by the asset in future years.

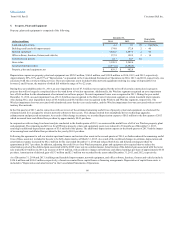

- Effective January 24, 2013, the completion date of CyrusOne's IPO, our ownership in CyrusOne is accounted for as an equity

method investment. From that date, we recognize our proportionate share of CyrusOne's net income or loss as non-operating income or expense in our

Consolidated Statement of Operations. For the period January 1, 2013 through January 23, 2013, we consolidated CyrusOne's operating results. For the year

ended December 31, 2014 and December 31, 2013, the Company received cash dividends from CyrusOne totaling $28.4 million and $21.3 million,

respectively. Dividends from CyrusOne are recognized as a reduction of our investment.

During 2014, we invested a total of $5.5 million in other entities, which are accounted for as equity method investments and the carrying value has been

recorded within “Other noncurrent assets” in the Consolidated Balance Sheets. The Company's proportionate share of the investments’ net loss had a minimal

impact on our Consolidated Statement of Operations.

Our equity method investments are tested for impairment on an annual basis or when events or changes in circumstances indicate that such assets may be

impaired.

Certain of our cost method investments do not have readily determinable fair values. The carrying value of these investments

was $2.9 million and $2.5 million as of December 31, 2014 and 2013, respectively, and was included in “Other noncurrent assets” in the Consolidated

Balance Sheets. Investments are reviewed annually for impairment, or sooner if changes in circumstances indicate the carrying value may not be recoverable.

If the carrying value of the investment exceeds its estimated fair value and the decline in value is determined to be other-than-temporary, an impairment loss

is recognized for the difference. The Company estimates fair value using external information and discounted cash flow analysis.

Certain property and equipment are leased. At lease inception, the lease terms are assessed to determine if the transaction should be classified as a

capital or operating lease.

Several of the buildings used in our former data center operations were leased facilities. When we were involved in the construction of structural

improvements to the leased property, we were deemed the accounting owner of leased real estate. In these instances, we bore substantially all the construction

period risk, such as managing or funding construction. These transactions generally did not qualify for sale-leaseback accounting due to our continued

involvement in these data center operations. As construction progressed, the value of the asset and obligation was increased by the fair value of the structural

improvements. When construction was completed, the asset was placed in service and depreciation commenced. Leased real estate was depreciated to the

lesser of (i) its estimated fair value at the end of the term or (ii) the expected amount of the unamortized obligation at the end of the term.

The repurchase of common shares is recorded at purchase cost as treasury shares. Our policy is to retire, either formally or constructively,

treasury shares that management anticipates will not be reissued. Upon retirement, the purchase cost of the treasury shares that exceeds par value is recorded

as a reduction to “Additional paid-in capital” in the Consolidated Balance Sheets.

We apply the revenue recognition principles described in Financial Accounting Standards Board (“FASB”) Accounting Standards

Codification Topic ("ASC") 605, “Revenue Recognition.” Under ASC 605, revenue is recognized when there is persuasive evidence of a sale arrangement,

delivery has occurred or services have been rendered, the sales price is fixed or determinable, and collectability is reasonably assured.

With respect to arrangements with multiple deliverables, management determines whether more than one unit of accounting exists in an arrangement. To the

extent that the deliverables are separable into multiple units of accounting, total consideration is allocated to the individual units of accounting based on

their relative fair value, determined by the price of each deliverable when it is regularly sold on a stand-alone basis. Revenue is recognized for each unit of

accounting as delivered, or as service is performed, depending on the nature of the deliverable comprising the unit of accounting.

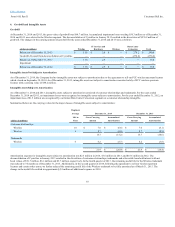

The Company has sales with one large customer that contributed 14% to consolidated revenue in 2014. The same customer had receivables of 26% and 19%

of the outstanding accounts receivable balance as of December 31, 2014 and 2013, respectively.

78