Cincinnati Bell 2014 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2014 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Form 10-K Part II

Cincinnati Bell Inc.

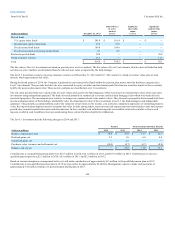

As permitted under Ohio law, the Company has agreements whereby the Company indemnifies its officers and directors for certain events or occurrences

while the officer or director is, or was, serving at the Company's request in such capacity. The term of the indemnification period is for the lifetime of the

officer or director. The maximum potential amount of future payments the Company could be required to make under these indemnification agreements is

unlimited; however, the Company has a director and officer insurance policy that limits the Company's exposure and enables the Company to recover a

portion of any future amounts paid. As a result of the Company's insurance policy coverage, the Company believes the estimated fair value of these

indemnification agreements is minimal. The Company has no liabilities recorded for these agreements as of December 31, 2014 or 2013.

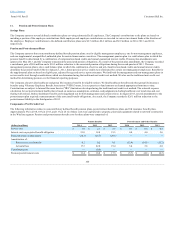

The Company has noncancellable purchase commitments related to certain goods and services. These agreements range from one to three years. As of

December 31, 2014 and 2013, the minimum commitments for these arrangements were approximately $178 million and $117 million, respectively. The

Company generally has the right to cancel open purchase orders prior to delivery and to terminate the contracts without cause.

Cincinnati Bell and its subsidiaries are subject to various lawsuits, actions, proceedings, claims and other matters asserted under laws and regulations in the

normal course of business. We believe the liabilities accrued for legal contingencies in our consolidated financial statements, as prescribed by GAAP, are

adequate in light of the probable and estimable contingencies. However, there can be no assurances that the actual amounts required to satisfy alleged

liabilities from various legal proceedings, claims, tax examinations, and other matters, and to comply with applicable laws and regulations, will not exceed

the amounts reflected in our consolidated financial statements. As such, costs, if any, that may be incurred in excess of those amounts provided as of

December 31, 2014, cannot be reasonably determined.

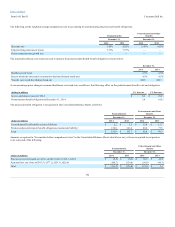

In 2010, the Company's Board of Directors approved long-term incentive programs for certain members of management. Payment was contingent upon the

completion of a qualifying transaction and attainment of an increase in the equity value of the data center business, as defined in the plans.

The CyrusOne IPO completed on January 24, 2013 was a qualifying transaction and triggered payments under this contingent compensation plan. For the

year ended December 31, 2013, compensation expense of $42.6 million was recognized for these awards and other transaction-related incentives, of which

$20.0 million was associated with CyrusOne employees. This expense has been presented as transaction-related compensation in our Consolidated Statement

of Operations for the year ended December 31, 2013.

96