Cincinnati Bell 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Form 10-K Part II

Cincinnati Bell Inc.

provision has been made for all such asserted and unasserted claims in accordance with GAAP. Such matters are subject to many uncertainties and outcomes

that are not predictable with assurance.

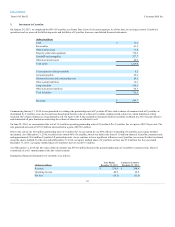

Cash consists of funds held in bank accounts. Cash equivalents consist of short-term, highly liquid investments with original

maturities of three months or less.

Receivables consist principally of trade receivables from customers and are generally unsecured and due within 21 - 90 days. The Company

has receivables with one large customer that makes up 26% and 19% of the outstanding accounts receivable balance at December 31, 2014 and 2013,

respectively. Unbilled receivables arise from services rendered but not yet billed. As of December 31, 2014 and 2013, unbilled receivables totaled $15.6

million and $23.2 million, respectively. Expected credit losses related to trade receivables are recorded as an allowance for uncollectible accounts in the

Consolidated Balance Sheets. The Company establishes the allowances for uncollectible accounts using percentages of aged accounts receivable balances to

reflect the historical average of credit losses as well as specific provisions for certain identifiable, potentially uncollectible balances. When internal

collection efforts on accounts have been exhausted, the accounts are written off and the associated allowance for uncollectible accounts is reduced.

Inventory, materials and supplies consists of wireline network components, various telephony and IT equipment to be

sold to customers, wireless handsets to support our agreement with Verizon Wireless to sell their products and services in our retail stores, maintenance

inventories, and other materials and supplies, which are carried at the lower of average cost or market. As of December 31, 2013, the Wireless segment

maintained handsets to support the wireless business.

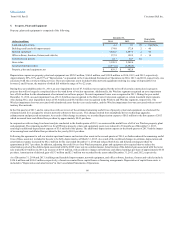

Property, plant and equipment is stated at original cost and presented net of accumulated depreciation and impairment

losses. Maintenance and repairs are charged to expense as incurred while improvements which extend an asset's useful life or increase its functionality are

capitalized and depreciated over the asset's remaining life. The majority of the Wireline network property, plant and equipment used to generate its voice and

data revenue is depreciated using the group method, which develops a depreciation rate annually based on the average useful life of a specific group of assets

rather than for each individual asset as would be utilized under the unit method. The estimated life of the group changes as the composition of the group of

assets and their related lives change. Provision for depreciation of other property, plant and equipment, except for leasehold improvements, is based on the

straight-line method over the estimated economic useful life. Depreciation of leasehold improvements is based on a straight-line method over the lesser of the

economic useful life of the asset or the term of the lease, including optional renewal periods if renewal of the lease is reasonably assured.

Additions and improvements, including interest and certain labor costs incurred during the construction period, are capitalized. The Company records the fair

value of a legal liability for an asset retirement obligation in the period it is incurred. The estimated removal cost is initially capitalized and depreciated over

the remaining life of the underlying asset. The associated liability is accreted to its present value each period. Once the obligation is ultimately settled, any

difference between the final cost and the recorded liability is recognized as gain or loss on disposition.

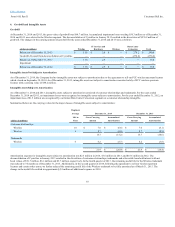

Goodwill — Goodwill represents the excess of the purchase price consideration over the fair value of net assets acquired and recorded in connection with

business acquisitions. Goodwill is generally allocated to reporting units one level below business segments. Goodwill is tested for impairment on an annual

basis or when events or changes in circumstances indicate that such assets may be impaired. If the net book value of the reporting unit exceeds its fair value,

an impairment loss may be recognized. An impairment loss is measured as the excess of the carrying value of goodwill of a reporting unit over its implied fair

value. The implied fair value of goodwill represents the difference between the fair value of the reporting unit and the fair value of all the assets and liabilities

of that unit, including any unrecognized intangible assets.

Intangible assets not subject to amortization — Intangible assets represent purchased assets that lack physical substance but can be separately distinguished

from goodwill because of contractual or legal rights, or because the asset is capable of being separately sold or exchanged. Intangible assets not subject to

amortization are tested for impairment annually, or when events or changes in circumstances indicate that the asset might be impaired. Prior to completing

the sale of our wireless spectrum licenses, Federal Communications Commission ("FCC") licenses for wireless spectrum represented indefinite-lived

intangible assets and were renewed annually for a nominal fee based on meeting service and geographic coverage requirements.

77