Cincinnati Bell 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Form 10-K Part II

Cincinnati Bell Inc.

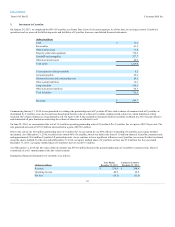

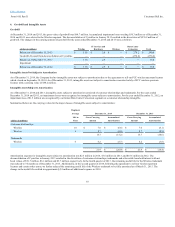

At December 31, 2014, amounts receivable from and payable to CyrusOne were as follows:

Accounts receivable

$ 1.7

$ 2.1

Dividends receivable

6.0

7.1

Receivable from CyrusOne

$ 7.7

$ 9.2

Accounts payable

$ 0.4

$ 0.5

Payable to CyrusOne

$ 0.4

$ 0.5

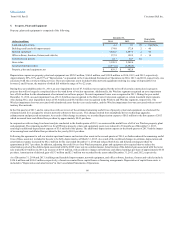

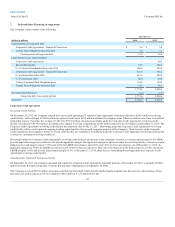

Basic earnings per common share ("EPS") is based upon the weighted-average number of common shares outstanding during the period. Diluted EPS reflects

the potential dilution that would occur upon issuance of common shares for awards under stock-based compensation plans, exercise of warrants, or

conversion of preferred stock, but only to the extent that they are considered dilutive.

The following table shows the computation of basic and diluted EPS:

Numerator:

Net income (loss) $ 75.6

$ (54.7)

$ 11.2

Preferred stock dividends 10.4

10.4

10.4

Net income (loss) applicable to common shareowners - basic and diluted $ 65.2

$ (65.1)

$ 0.8

Denominator:

Weighted-average common shares outstanding - basic 208.5

205.9

197.0

Warrants —

—

4.5

Stock-based compensation arrangements 1.1

—

3.2

Weighted-average common shares outstanding - diluted 209.6

205.9

204.7

Basic and diluted earnings (loss) per common share $ 0.31

$ (0.32)

$ 0.00

For the year ended December 31, 2014, awards under the Company’s stock-based compensation plans for common shares of 3.6 million were excluded from

the computation of diluted EPS as their inclusion would have been anti-dilutive. For the year ended December 31, 2013, the Company had a net loss

available to common shareholders and, as a result, all common stock equivalents were excluded from the computation of diluted EPS as their inclusion would

have been anti-dilutive. For the year ended December 31, 2012, awards under our stock-based compensation plans for common shares of 5.3 million were

excluded from the computation of diluted EPS as their inclusion would have been anti-dilutive. For all periods presented, preferred stock convertible into 4.5

million common shares was excluded as it was anti-dilutive.

85