Cincinnati Bell 2014 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2014 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Form 10-K Part II

Cincinnati Bell Inc.

Awards granted to employees generally vest in one-third increments over a period of three years. Awards granted to directors in 2012 and in prior years vest

on the third anniversary of the grant date. Awards granted to directors in 2013 vest on the second anniversary of the grant date. Awards granted in 2014 vest

on the first anniversary of the grant date.

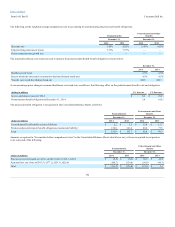

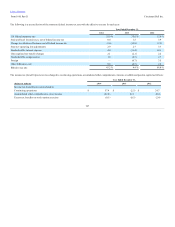

The following table summarizes our time-based restricted award activity:

Non-vested at January 1, 1,044

$ 3.55

1,298

$ 3.11

872

$ 2.89

Granted 176

3.19

279

4.72

725

3.26

Vested (514)

3.25

(454)

3.03

(299)

2.83

Forfeited (22)

3.19

(79)

3.40

—

—

Non-vested at December 31, 684

$ 3.70

1,044

$ 3.55

1,298

$ 3.11

Compensation expense for the year $ 1.6

$ 1.7

$ 1.5

Tax benefit related to compensation expense $ (0.6)

$ (0.6)

$ (0.6)

Grant date fair value of awards vested $ 1.7

$ 1.4

$ 0.8

As of December 31, 2014, there was $0.6 million of unrecognized compensation expense related to these restricted stock awards, which is expected to be

recognized over a weighted-average period of approximately one year.

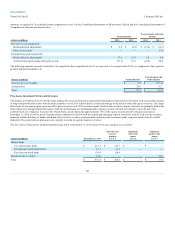

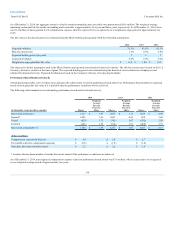

The Company granted 531,000 cash-settled stock appreciation rights awards in 2012 with a grant date value of $0.8 million. A Black-Scholes pricing model

was utilized to determine the fair value of these awards at the date of grant. For awards granted in 2012, the weighted-average fair value per share was $1.32.

The final payments of these awards will be indexed to the percentage change in the Company’s stock price from the date of grant. At December 31, 2014, the

amount of remaining unrecognized compensation expense for cash-settled stock appreciation rights was nominal. The aggregate intrinsic value of

outstanding and exercisable awards at December 31, 2014 was $0.3 million and $0.4 million, respectively.

The Company also granted cash-payment performance awards in 2014 and 2012 with base awards of $3.6 million and $2.3 million, respectively, with the

final award payment indexed to the percentage change in the Company’s stock price from the date of grant. No cash-payment awards were issued in 2013. In

2014, we recorded $0.6 million of expense related to these awards, a $0.2 million benefit in 2013 and $4.4 million of expense in 2012.

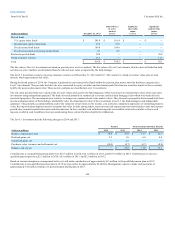

The Company currently has deferred compensation plans for both the Board of Directors and certain executives of the Company. Under the directors deferred

compensation plan, each director can defer receipt of all or a part of their director fees and annual retainers, which can be invested in various investment

funds including the Company’s common stock. In years prior to 2012, the Company granted 6,000 phantom shares to each non-employee director on the first

business day of each year, which are fully vested once a director has five years of service. No phantom shares were granted to non-employee directors in 2014.

Distributions to the directors are generally in the form of cash. The executive deferred compensation plan allows for certain executives to defer a portion of

their annual base pay, bonus, or stock awards. Under the executive deferred compensation plan, participants can elect to receive distributions in the form of

either cash or common shares.

111