Cincinnati Bell 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Form 10-K Part II

Cincinnati Bell Inc.

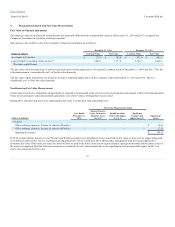

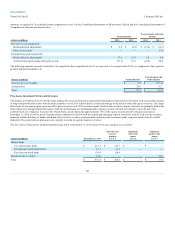

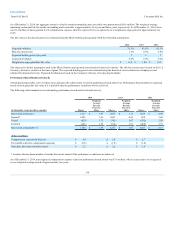

Mutual funds

U.S. equity index funds

$ 201.4

$ 201.4

$ —

$ —

International equity index funds

57.0

57.0

—

—

Fixed income bond funds

109.8

109.8

—

—

Fixed income short-term money market funds

0.3

0.3

—

—

Real estate pooled funds

30.8

—

—

30.8

Group insurance contract

11.3

—

—

11.3

Total

$ 410.6

$ 368.5

$ —

$ 42.1

The fair values of Level 1 investments are based on quoted prices in active markets. The fair values of Level 2 investments, which consist of funds that hold

securities in active markets, are determined based on the net asset value as reported by the fund manager.

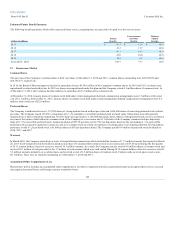

The Level 3 investment consists of a group insurance contract as of December 31, 2014 and 2013. The contract is valued at contract value plus accrued

interest, which approximates fair value.

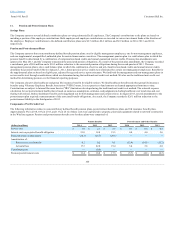

During the fourth quarter of 2014, the Company liquidated the real estate pooled funds within the pension plan master trust that had been categorized as

Level 3 investments. The proceeds from the sale were reinvested in equity securities and investment grade fixed income securities similar to those currently

held by the pension plan master trust. These new investments are classified as Level 1 investments.

The real estate pooled funds were valued at the net asset values disclosed by the fund managers, which were based on estimated fair values of the real estate

investments using independent appraisal. The funds invested primarily in commercial real estate and included mortgage loans which were backed by the

associated properties. The investments were sensitive to changes in commercial real estate market values. They focused on properties that returned both lease

income and appreciation of the buildings’ marketable value. In estimating fair value of the investments in level 3, the fund managers used independent

appraisers. The generally accepted methods used in the valuation of real estate are the income, cost, and sales comparison approaches of estimating property

value. Key inputs and assumptions used to determine fair value include among others, rental revenue and expense amounts and related revenue and expense

growth rates, terminal capitalization rates and discount rates. In the event that total withdrawal requests exceeded the total cash available to honor such

requests, available cash would have been pro-rated among those contract-holders eligible for withdrawals.

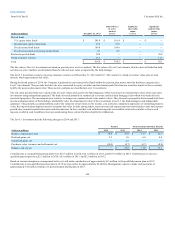

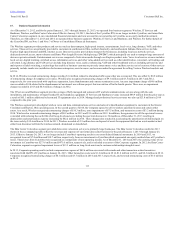

The Level 3 investments had the following changes in 2014 and 2013:

Balance, beginning of year $ 30.8

$ 27.8

$ 11.3

$ 11.7

Realized gains, net 3.2

1.0

0.4

0.4

Unrealized gains, net —

2.7

—

—

Purchases, sales, issuances and settlements, net (34.0)

(0.7)

(0.7)

(0.8)

Balance, end of year $ —

$ 30.8

$ 11.0

$ 11.3

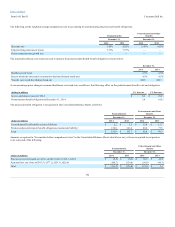

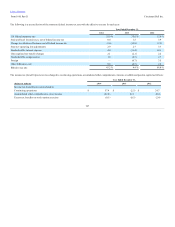

Contributions to our qualified pension plans were $19.7 million in 2014, $42.1 million in 2013, and $23.9 million in 2012. Contributions to our non-

qualified pension plan were $2.3 million in 2014, $2.9 million in 2013, and $2.0 million in 2012.

Based on current assumptions, management believes it will make contributions of approximately $13 million to the qualified pension plan in 2015.

Contributions to non-qualified pension plans in 2015 are expected to be approximately $2 million. Management expects to make cash payments of

approximately $12 million related to its postretirement health plans in 2015.

104