Cincinnati Bell 2014 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2014 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Form 10-K Part II

Cincinnati Bell Inc.

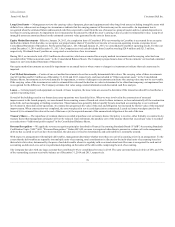

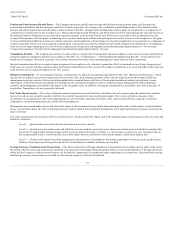

In July 2013, the FASB issued new guidance under Accounting Standards Update ("ASU") 2013-11 regarding the presentation of unrecognized tax benefits

in financial statements. This new standard requires the netting in the balance sheet of unrecognized tax benefits against a deferred tax asset for a same-

jurisdiction loss or other carryforward that would apply in settlement of the uncertain tax positions. To the extent a net operating loss ("NOL") or tax credit

carryforward is not available under the tax law of the applicable jurisdiction to settle any additional income taxes that would result from the disallowance of

a tax position, the unrecognized tax benefit would be presented in the balance sheet as a liability. This standard went into effect for annual and interim

periods beginning after December 15, 2013. We adopted this new guidance beginning with our interim financial statements for the three months ended

March 31, 2014. The adoption of this standard did not have a material impact on our financial statements for the year ended December 31, 2014.

In February 2013, the FASB amended the guidance in ASC 220 on comprehensive income. The new guidance requires additional information to be disclosed

about the amounts reclassified out of accumulated other comprehensive income by the respective line items of net income, but only if the amounts

reclassified are required under GAAP to be reclassified in their entirety to net income. For other amounts that are not required under GAAP to be reclassified

in their entirety to net income, cross references to other disclosures will be required. As we adopted this new guidance beginning with our interim financial

statements for the three months ended March 31, 2013, all years presented are comparable. See Note 12 for our disclosures.

In April 2014, the FASB issued ASU 2014-08, Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity. The

amendments in this update increased the threshold for a disposal to qualify as a discontinued operation and require new disclosures of both discontinued

operations and certain other disposals that do not meet the definition of a discontinued operation. The standard will be effective for us on January 1, 2015.

The adoption of this pronouncement may affect our presentation and disclosure of any future dispositions.

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers. The standard’s core principle is that a company will recognize

revenue when it transfers promised goods or services to customers in an amount that reflects the consideration to which the company expects to be entitled in

exchange for those goods or services. This standard also includes expanded disclosure requirements that result in an entity providing users of financial

statements with comprehensive information about the nature, amount, timing, and uncertainty of revenue and cash flows arising from the entity’s contracts

with customers. This standard will be effective for us in the first quarter of the fiscal year ending December 31, 2017. The Company is currently in the process

of evaluating the impact of adoption of this ASU on the company’s consolidated financial statements.

In August 2014, the FASB issued ASU 2014-15, Disclosure of Uncertainties About an Entity's Ability to Continue as a Going Concern. The amendments

provide guidance about management’s responsibility to evaluate whether there is substantial doubt about an entity’s ability to continue as a going concern

and to provide related footnote disclosures. The standard will be effective for us on January 1, 2016. The adoption of this pronouncement is not expected to

have a material impact on our financial statements.

On January 9, 2015, the FASB issued ASU 2015-01, Income Statement-Extraordinary and Unusual Items. The updated standard will no longer allow for

transactions that are unusual in nature and occur infrequently to be presented net-of-tax after income from continuing operations as an extraordinary item in

the Consolidated Statements of Operations. Under the new guidance, these transactions will be separately presented within income from continuing

operations similar to current guidance for transactions that are unusual in nature or occur infrequently. The standard will be effective for us on January 1,

2016. The adoption of this pronouncement is not expected to have a material impact on our financial statements as there are no transactions presented as an

extraordinary item on the Consolidated Statements of Operations.

Other accounting standards that have been issued or proposed by the FASB or other standards-setting bodies that do not require adoption until a future date

are not expected to have a material impact on the Company’s consolidated financial statements upon adoption.

82