Cincinnati Bell 2014 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2014 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Form 10-K Part II

Cincinnati Bell Inc.

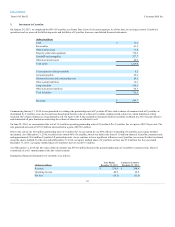

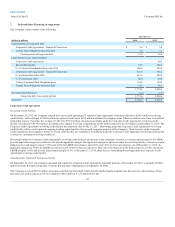

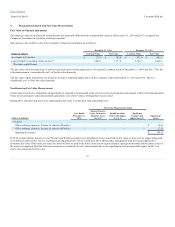

The Company’s debt consists of the following:

Current portion of long-term debt:

Corporate Credit Agreement - Tranche B Term Loan $ 5.4

$ 5.4

Capital lease obligations and other debt 7.8

7.2

Current portion of long-term debt 13.2

12.6

Long-term debt, less current portion:

Corporate Credit Agreement —

40.0

Receivables facility 19.2

106.2

8 3/4% Senior Subordinated Notes due 2018 300.0

625.0

Corporate Credit Agreement - Tranche B Term Loan 527.8

533.2

8 3/8% Senior Notes due 2020 661.2

683.9

7 1/4% Notes due 2023 40.0

40.0

Various Cincinnati Bell Telephone notes 134.5

134.5

Capital lease obligations and other debt 91.5

96.1

1,774.2

2,258.9

Net unamortized discount (3.2)

(6.3)

Long-term debt, less current portion 1,771.0

2,252.6

Total debt $ 1,784.2

$ 2,265.2

Revolving Credit Facility

On November 20, 2012, the Company entered into a new credit agreement ("Corporate Credit Agreement") which provided for a $200.0 million revolving

credit facility, with a sublimit of $30.0 million for letters of credit and a $25.0 million sublimit for swingline loans. Effective with the sale of our 16.0 million

partnership units to CyrusOne, Inc. on June 25, 2014 for $355.9 million, the amount available under the Corporate Credit Agreement's revolving credit

facility was reduced to $150.0 million. In addition, the original revolving commitments will be further reduced to $125.0 million on December 31, 2015. The

Corporate Credit Agreement's revolving credit facility has a maturity date of July 15, 2017. Borrowings under the Corporate Credit Agreement's revolving

credit facility will be used to provide ongoing working capital and for other general corporate purposes of the Company. Upon issuance of the Corporate

Credit Agreement, the Company's former revolving credit facility was terminated. Availability under the Corporate Credit Agreement revolving credit facility

is subject to customary borrowing conditions.

Borrowings under the Corporate Credit Agreement's revolving credit facility bear interest, at the Company's election, at a rate per annum equal to (i) LIBOR

plus the applicable margin or (ii) the base rate plus the applicable margin. The applicable margin for advances under the revolving facility is based on certain

financial ratios and ranges between 3.50% and 4.25% for LIBOR rate advances and 2.50% and 3.25% for base rate advances. As of December 31, 2014, the

applicable margin was 4.00% for LIBOR rate advances and 3.00% for base rate advances. Base rate is the higher of (i) the bank prime rate, (ii) the one-month

LIBOR rate plus 1.00% and (iii) the federal funds rate plus 0.5%. At December 31, 2014, there were no outstanding borrowings under the Corporate Credit

Agreement's revolving credit facility.

Amendment for Tranche B Term Loan Facility

On September 10, 2013, the Company amended and restated its Corporate Credit Agreement, originally dated as of November 20, 2012, to include a $540.0

million Tranche B Term Loan facility ("Tranche B Term Loan") that matures on September 10, 2020.

The Company received $529.8 million in net proceeds from the Tranche B Term Loan after deducting the original issue discount, fees and expenses. These

proceeds were used to redeem all of the Company's $500.0 million 8 1/4% Senior Notes due

89