Cigna 2013 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2013 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

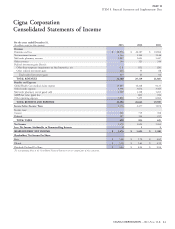

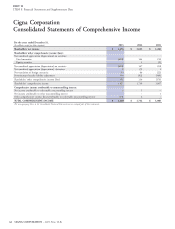

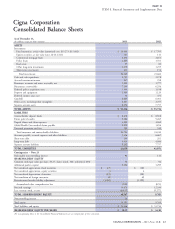

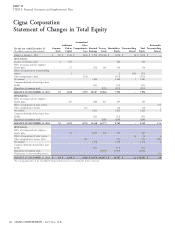

PART II

ITEM 8. Financial Statements and Supplementary Data

Notes to the Consolidated Financial Statements

Description of Business

Cigna Corporation and its subsidiaries (either individually or other groups (e.g. governmental and non-governmental organizations,

collectively referred to as ‘‘Cigna’’, ‘‘the Company’’, ‘‘we’’, or ‘‘our’’) is a unions and associations). Cigna also offers Medicare and Medicaid

global health services organization with a mission to help its products and health, life and accident insurance coverages primarily to

customers improve their health, well-being and sense of security. Its individuals in the U.S. and selected international markets. In addition

insurance subsidiaries are major providers of medical, dental, to its ongoing operations described above, Cigna also has certain

disability, life and accident insurance and related products and run-off operations, including a Run-off Reinsurance segment.

services, the majority of which are offered through employers and

Summary of Significant Accounting Policies

Disclosures about Offsetting Assets and Liabilities (ASU 2011-11).

The FASB’s requirements to disclose information on both a gross and

The Consolidated Financial Statements include the accounts of Cigna net basis for certain derivatives, repurchase and reverse repurchase

Corporation and its subsidiaries. Intercompany transactions and agreements, and securities borrowing and lending transactions that are

accounts have been eliminated in consolidation. either offset in accordance with specific criteria or subject to a master

netting or similar arrangement became effective January 1, 2013.

These Consolidated Financial Statements were prepared in There were no effects to the Company’s financial statements because

conformity with accounting principles generally accepted in the no transactions or arrangements were subject to these new disclosure

United States of America (‘‘GAAP’’). Amounts recorded in the requirements.

Consolidated Financial Statements necessarily reflect management’s

estimates and assumptions about medical costs, investment valuation, Investment Company Accounting (ASU 2013-08). The FASB issued

interest rates and other factors. Significant estimates are discussed accounting guidance to change the criteria for reporting as an

throughout these Notes; however, actual results could differ from investment company, clarify the fair value measurement used by an

those estimates. The impact of a change in estimate is generally investment company and require additional disclosures. This

included in earnings in the period of adjustment. Certain guidance also confirms that parent company accounting for an

reclassifications have been made to prior year amounts to conform to investment company should reflect fair value accounting and is

the current presentation. effective beginning on January 1, 2014. Adoption of this standard is

not expected to have a material impact on the Company’s financial

In preparing these Consolidated Financial Statements, the Company statements.

has evaluated events that occurred between the balance sheet date and

February 27, 2014. Fees Paid to the Federal Government by Health Insurers (ASU

2011-06). In 2011, the FASB issued accounting guidance for the

Variable interest entities. As of December 31, 2013 and 2012 the health insurance industry assessment (the ‘‘fee’’) mandated by the

Company determined it was not a primary beneficiary in any material Patient Protection and Affordable Care Act of 2010 (‘‘Health Care

variable interest entities. Reform’’). The fee will be levied on health insurers beginning in 2014

based on a ratio of an insurer’s net health insurance premiums written

for the previous calendar year compared to the U.S. health insurance

industry total. In addition, because these fees will generally not be tax

deductible, the Company’s effective tax rate is expected to increase

beginning in 2014. Under the guidance, the liability for the fee will be

Reporting of Amounts Reclassified Out of Accumulated Other estimated and recorded in full each year beginning in 2014 when

Comprehensive Income (‘‘AOCI’’) (Accounting Standards Update health insurance is first provided. A corresponding deferred cost will

(‘‘ASU’’) 2013-02). Effective January 1, 2013, the Company be recorded and amortized over the calendar year. The fee is expected

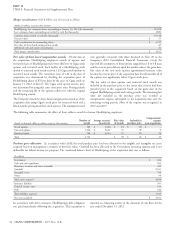

adopted updated guidance from the Financial Accounting Standards to be approximately $230 million in 2014: $130 million related to the

Board (‘‘FASB’’) on reporting items of AOCI reclassified to net commercial business and $100 million related to the Medicare

income. The updated guidance requires disclosures of the effect of business. The Company anticipates recovering most of the industry

items reclassified out of AOCI into net income on each individual line fee related to our commercial business through rate increases. For the

item in the statement of income. See Note 17 for the Company’s Company’s Medicare business, although we expect to partially

updated disclosures. mitigate the effect of the fee through 2014 benefit changes and prices,

66 CIGNA CORPORATION - 2013 Form 10-K

NOTE 1

NOTE 2

A. Basis of Presentation

B. Changes in Accounting

Pronouncements