Cigna 2013 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2013 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

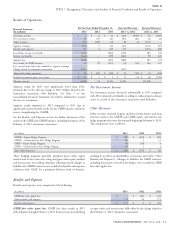

Loss ratios increased in 2013 and 2012 compared with each prior year,

Other Items Affecting Global Supplemental Benefits

reflecting the inherently higher loss ratios of the acquisitions.

Results

Policy acquisition expenses increased in 2013 and 2012, compared For our Global Supplemental Benefits segment, South Korea is the

with the prior year, reflecting the acquisitions and business growth, single largest geographic market, generating 51% of segment revenues

partially offset by lower acquisition costs in Europe reflecting a and 87% of the segment earnings in 2013. Due to the concentration

decision to cease selling activities in certain markets during 2012. of business in South Korea, the Global Supplemental Benefits

segment is exposed to potential losses resulting from economic,

Excluding the realignment and efficiency charges from 2013 and

regulatory and geopolitical developments in that country, as well as

2012, expense ratios decreased in 2013 compared with 2012. The

foreign currency movements affecting the South Korean currency, that

decrease was primarily driven by the impact of the lower expense

could have a significant impact on the segment’s results and our

ratios associated with the Great American Supplemental Benefits

consolidated financial results. In 2013, our operations in South Korea

business, partially offset by strategically planned investment spending

represented 4% of Cigna’s total consolidated revenues and 10% of

to support future business growth. Excluding special items, expense

shareholders’ net income.

ratios increased in 2012 compared with 2011 primarily driven by the

impact of higher expense ratios associated with FirstAssist.

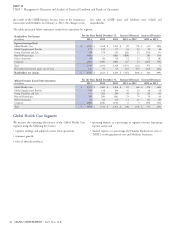

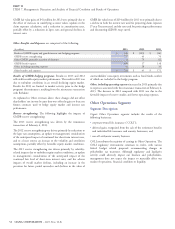

Group Disability and Life Segment

The increase in the effective tax rate in 2013 compared with 2012 and Key factors for this segment are:

the decrease in 2012 compared with 2011 are largely due to

implementing a capital management strategy in 2013 and 2012. premium growth, including new business and customer retention;

Excluding those effects, the Global Supplemental Benefits segment’s net investment income;

effective tax rate was 24.0% in 2013, 24.6% in 2012, and 27.3% in

2011. The continued decline in these rates reflects the favorable benefits expense as a percentage of earned premium (loss ratio); and

effects of our capital management strategy. other operating expense as a percentage of earned premiums and

fees (expense ratio).

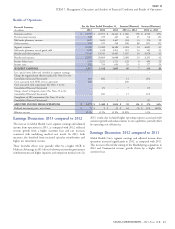

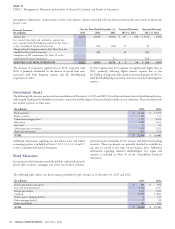

Results of Operations

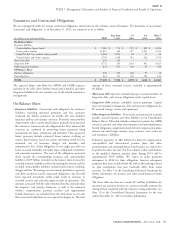

For the Years Ended December 31, Increase/(Decrease) Increase/(Decrease)

Financial Summary

(In millions)

2013 2012 2011 2013 vs. 2012 2012 vs. 2011

Premiums and fees $ 3,425 $ 3,109 $ 2,857 $ 316 10% $ 252 9%

Net investment income 321 300 291 21 7 9 3

Other revenues 1 – – 1 – – –

Segment revenues 3,747 3,409 3,148 338 10 261 8

Benefits and expenses 3,387 3,014 2,740 373 12 274 10

Income before taxes 360 395 408 (35) (9) (13) (3)

Income taxes 101 116 113 (15) (13) 3 3

SEGMENT EARNINGS 259 279 295 (20) (7) (16) (5)

Less: special items (after-tax) included in segment earnings:

Charge for disability claims regulatory matter (See Note 23 to

the Consolidated Financial Statements) (51) – – (51) –

Charge for organizational efficiency plans (See Note 6 to the

Consolidated Financial Statements) (1) (2) – 1 (2)

Completion of IRS examination (See Note 19 to the

Consolidated Financial Statements) – – 5 – (5)

ADJUSTED INCOME FROM OPERATIONS $ 311 $ 281 $ 290 $ 30 11% $ (9) (3)%

Realized investment gains, net of taxes $ 40 $ 18 $ 7 $ 22 122% $ 11 157%

Effective tax rate 28.1% 29.4% 27.7% (1.3)% 1.7%

include the $29 million favorable after-tax effect of a higher discount

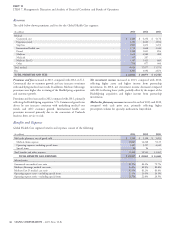

Earnings Discussion: 2013 compared to 2012

rate on claims incurred during 2013 as a result of reallocating higher

The decrease in segment earnings was primarily due to a charge yielding assets to the disability and life portfolio. Results in 2012

associated with a disability claims regulatory matter discussed further include the $43 million after-tax favorable impact of reserve reviews.

in the Overview section of this MD&A. Adjusted income from The favorable impact of the reserve reviews continues to reflect strong

operations increased in 2013, reflecting a lower disability loss ratio, operational performance by the disability claims management

higher net investment income and a lower expense ratio, partially operation as well as reserve assumptions consistent with current

offset by a higher life loss ratio. Results in 2013 include the favorable business and economic conditions.

after-tax effect of reserve reviews of $60 million. Results in 2013 also

CIGNA CORPORATION - 2013 Form 10-K 49

•

•

•

•