Cigna 2013 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2013 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

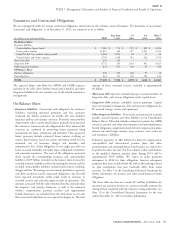

Liquidity requirements at the subsidiary level generally consist of: borrowing from the parent company.

claim and benefit payments to policyholders; and Liquidity requirements at the parent company level generally consist

of:

operating expense requirements, primarily for employee

compensation and benefits. debt service and dividend payments to shareholders; and

Our subsidiaries normally meet their operating requirements by: pension plan funding.

maintaining appropriate levels of cash, cash equivalents and The parent company normally meets its liquidity requirements by:

short-term investments; maintaining appropriate levels of cash, cash equivalents and

using cash flows from operating activities; short-term investments;

selling investments; collecting dividends from its subsidiaries;

matching investment durations to those estimated for the related using proceeds from issuance of debt and equity securities; and

insurance and contractholder liabilities; and borrowing from its subsidiaries.

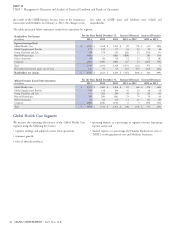

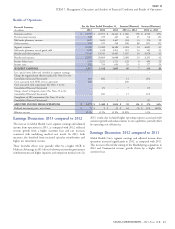

Cash flows for the years ended December 31, were as follows:

(In millions)

2013 2012 2011

Net cash provided by operating activities $ 719 $ 2,350 $ 1,491

Net cash provided by (used in) investing activities $ 15 $ (3,857) $ (1,270)

Net cash provided by (used in) financing activities $ (930) $ (228) $ 2,867

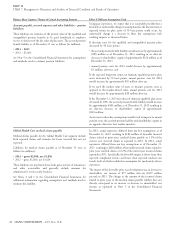

Cash flows from operating activities consist of cash receipts and

Investing activities

disbursements for premiums and fees, mail order pharmacy, other Cash flows from investing activities increased by $3.9 billion in 2013

revenues, investment income, taxes, benefits and expenses, and, prior compared with 2012 primarily driven by the absence of the 2012

to February 4, 2013, gains and losses recognized in connection with payment to acquire HealthSpring. Excluding that acquisition, cash

our GMDB and GMIB equity hedge programs. Because certain flows from investing activities in 2012 increased by $0.6 billion

income and expense transactions do not generate cash, and because compared with 2011 primarily due to lower net purchases of fixed

cash transactions related to revenues and expenses may occur in maturity investments.

periods different from when those revenues and expenses are

recognized in shareholders’ net income, cash flows from operating

activities can be significantly different from shareholders’ net income.

Financing activities

Cash flows from investing activities generally consist of net Cash used in financing activities in 2013 increased by $0.7 billion

investment purchases or sales and net purchases of property and compared with 2012 primarily due to higher repurchases of common

equipment including capitalized software, as well as cash used to stock. Cash provided by financing activities in 2011 was $2.9 billion,

acquire businesses. primarily consisting of net proceeds from long-term debt that was

issued to finance the 2012 HealthSpring acquisition.

Cash flows from financing activities are generally comprised of

issuances and re-payment of debt at the parent company level,

proceeds on the issuance of common stock resulting from stock

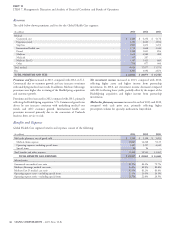

Share repurchase

option exercises, and stock repurchases. In addition, the subsidiaries We maintain a share repurchase program that was authorized by our

report net deposits and withdrawals to and from investment contract Board of Directors. The decision to repurchase shares depends on market

liabilities (that include universal life insurance liabilities) because such conditions and alternate uses of capital. We have, and may continue from

liabilities are considered financing activities with policyholders. time to time, to repurchase shares on the open market through a

Rule 10b5-1 plan that permits a company to repurchase its shares at

Operating activities

times when it otherwise might be precluded from doing so under insider

trading laws or because of self-imposed trading blackout periods. We

Cash provided by operating activities declined by $1.6 billion in 2013 suspend activity under this program from time to time and also remove

compared with 2012 primarily due to payments totaling $2.2 billion such suspensions, generally without public announcement.

made in 2013 to Berkshire in connection with the reinsurance

transaction. Cash provided by operating activities in 2012 increased In 2013 we repurchased 13.6 million shares for $1.0 billion. From

by $0.9 billion compared with 2011, primarily as a result of strong January 1, 2014 through February 26, 2014 we repurchased

earnings growth in our ongoing business segments and the absence of 5.0 million shares for $411 million. On February 26, 2014, the

claim run-out from the Medicare IPFFS business exited in 2011. Company’s Board of Directors increased share repurchase authority by

$500 million. Accordingly, the total remaining share repurchase

authorization as of February 26, 2014 was $901 million. In 2012 the

Company repurchased 4.4 million shares for $208 million and in

2011 repurchased 5.3 million shares for $225 million.

CIGNA CORPORATION - 2013 Form 10-K 37

•

•

•

•

•

•

•

•

••

••

•