Cigna 2013 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2013 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

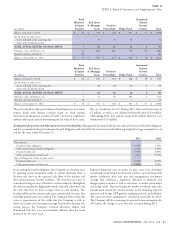

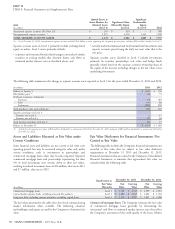

interest rates are derived by calculating the appropriate spread over buyers’ assets supporting these reinsured contracts. The Company had

comparable U.S. Treasury rates, based on the property type, quality a reinsurance recoverable equal to the carrying value of these reinsured

rating and average life of the loan. The quality ratings reflect the contracts. These instruments were classified in Level 3 because certain

relative risk of the loan, considering debt service coverage, the inputs are unobservable (supported by little or no market activity) and

loan-to-value ratio and other factors. Fair values of impaired mortgage significant to their resulting fair value measurement.

loans are based on the estimated fair value of the underlying collateral Long-term debt, including current maturities, excluding capital

generally determined using an internal discounted cash flow model. leases. The fair value of long-term debt is based on quoted market

The fair value measurements were classified in Level 3 because the prices for recent trades. When quoted market prices are not available,

cash flow models incorporate significant unobservable inputs. fair value is estimated using a discounted cash flow analysis and the

Contractholder deposit funds, excluding universal life products. Company’s estimated current borrowing rate for debt of similar terms

Generally, these funds do not have stated maturities. Approximately and remaining maturities. These measurements were classified in

60% of these balances can be withdrawn by the customer at any time Level 2 because the fair values are based on quoted market prices or

without prior notice or penalty. The fair value for these contracts is the other inputs that are market observable or can be corroborated by

amount estimated to be payable to the customer as of the reporting market data.

date, which is generally the carrying value. Most of the remaining Fair values of off-balance-sheet financial instruments were not

contractholder deposit funds are reinsured by the buyers of the material as of December 31, 2013 and 2012.

individual life and annuity and retirement benefits businesses. The

fair value for these contracts is determined using the fair value of these

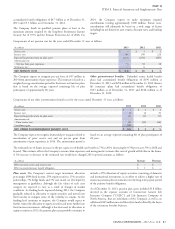

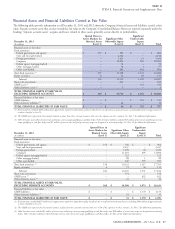

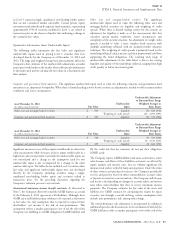

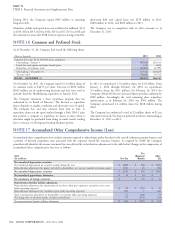

Investments

Securities in the following table are included in fixed maturities and equity securities on the Company’s Consolidated Balance Sheets. These

securities are carried at fair value with changes in fair value reported in other realized investment gains (losses) and interest and dividends reported

in net investment income. Hybrid investments include certain preferred stock or debt securities with call or conversion features.

(In millions)

2013 2012

Included in fixed maturities:

Trading securities (amortized cost: $1; $1) $1$1

Hybrid securities (amortized cost: $5; $15) 515

TOTAL $6$16

Included in equity securities:

Hybrid securities (amortized cost: $68; $84) $56$70

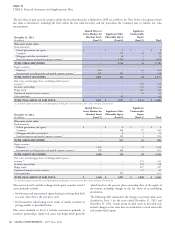

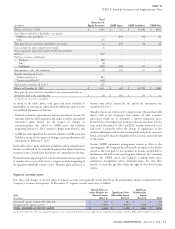

The following information about fixed maturities excludes trading and hybrid securities. The amortized cost and fair value by contractual

maturity periods for fixed maturities were as follows at December 31, 2013:

Amortized Fair

(In millions)

Cost Value

Due in one year or less $ 1,151 $ 1,173

Due after one year through five years 5,283 5,656

Due after five years through ten years 5,260 5,530

Due after ten years 2,622 3,084

Mortgage and other asset-backed securities 951 1,037

TOTAL $ 15,267 $ 16,480

Actual maturities could differ from contractual maturities because issuers may have the right to call or prepay obligations with or without

penalties. In some cases, the Company may also extend maturity dates.

CIGNA CORPORATION - 2013 Form 10-K 93

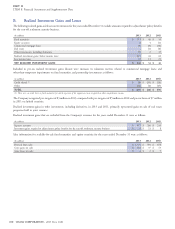

NOTE 11

A. Fixed Maturities and Equity Securities