Cigna 2013 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2013 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

backed securities, inputs and assumptions may also include

Level 1 Financial Assets

characteristics of the issuer, collateral attributes, prepayment speeds

Inputs for instruments classified in Level 1 include unadjusted quoted and credit rating.

prices for identical assets in active markets accessible at the

Nearly all of these instruments are valued using recent trades or

measurement date. Active markets provide pricing data for trades

pricing models. Less than 1% of the fair value of investments classified

occurring at least weekly and include exchanges and dealer markets.

in Level 2 represents foreign bonds that are valued using a single

Assets in Level 1 include actively-traded U.S. government bonds and unadjusted market-observable input derived by averaging multiple

exchange-listed equity securities. Given the narrow definition of broker-dealer quotes, consistent with local market practice.

Level 1 and the Company’s investment asset strategy to maximize

Short-term investments are carried at fair value which approximates

investment returns, a relatively small portion of the Company’s

cost. On a regular basis the Company compares market prices for

investment assets are classified in this category.

these securities to recorded amounts to validate that current carrying

amounts approximate exit prices. The short-term nature of the

Level 2 Financial Assets and Financial Liabilities

investments and corroboration of the reported amounts over the

holding period support their classification in Level 2.

Inputs for instruments classified in Level 2 include quoted prices for

similar assets or liabilities in active markets, quoted prices from those Other derivatives classified in Level 2 represent over-the-counter

willing to trade in markets that are not active, or other inputs that are instruments such as interest rate and foreign currency swap contracts.

market observable or can be corroborated by market data for the term Fair values for these instruments are determined using market

of the instrument. Such other inputs include market interest rates and observable inputs including forward currency and interest rate curves

volatilities, spreads and yield curves. An instrument is classified in and widely published market observable indices. Credit risk related to

Level 2 if the Company determines that unobservable inputs are the counterparty and the Company is considered when estimating the

insignificant. fair values of these derivatives. However, the Company is largely

protected by collateral arrangements with counterparties, and

Fixed maturities and equity securities. Approximately 91% of the determined that no adjustment for credit risk was required as of

Company’s investments in fixed maturities and equity securities are December 31, 2013 or December 31, 2012. The nature and use of

classified in Level 2 including most public and private corporate debt these other derivatives are described in Note 12.

and equity securities, federal agency and municipal bonds,

non-government mortgage-backed securities and preferred stocks.

Because many fixed maturities do not trade daily, third-party pricing

Level 3 Financial Assets and Financial Liabilities

services and internal methods often use recent trades of securities with

Certain inputs for instruments classified in Level 3 are unobservable

similar features and characteristics. When recent trades are not

(supported by little or no market activity) and significant to their

available, pricing models are used to determine these prices. These

resulting fair value measurement. Unobservable inputs reflect the

models calculate fair values by discounting future cash flows at

Company’s best estimate of what hypothetical market participants

estimated market interest rates. Such market rates are derived by

would use to determine a transaction price for the asset or liability at

calculating the appropriate spreads over comparable U.S. Treasury

the reporting date.

securities, based on the credit quality, industry and structure of the

asset. Typical inputs and assumptions to pricing models include, but The Company classifies certain newly issued, privately-placed,

are not limited to, a combination of benchmark yields, reported complex or illiquid securities, as well as assets and liabilities relating to

trades, issuer spreads, liquidity, benchmark securities, bids, offers, GMIB, in Level 3.

reference data, and industry and economic events. For mortgage-

Fixed maturities and equity securities. Approximately 7% of fixed maturities and equity securities are priced using significant unobservable

inputs and classified in this category, including:

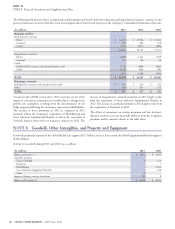

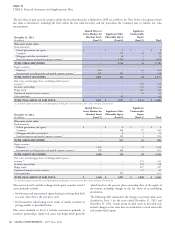

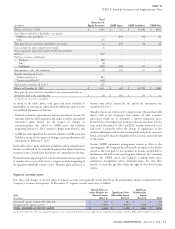

December 31, December 31,

(In millions)

2013 2012

Other asset and mortgage-backed securities – valued using pricing models $ 603 $ 598

Corporate and government fixed maturities – valued using pricing models 417 596

Corporate fixed maturities – valued at transaction price 111 123

Equity securities – valued at transaction price 59 34

TOTAL $ 1,190 $ 1,351

Fair values of other asset and mortgage-backed securities and characteristics. For other asset and mortgage-backed securities, inputs

corporate and government fixed maturities are primarily determined and assumptions for pricing may also include collateral attributes and

using pricing models that incorporate the specific characteristics of prepayment speeds. Recent trades in the subject security or similar

each asset and related assumptions including the investment type and securities are assessed when available, and the Company may also

structure, credit quality, industry and maturity date in comparison to review published research in its evaluation, as well as the issuer’s

current market indices, spreads and liquidity of assets with similar financial statements. Approximately 10% of fixed maturities classified

88 CIGNA CORPORATION - 2013 Form 10-K