Cigna 2013 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2013 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

in Level 3 represent single, unadjusted, non-binding broker quotes Other asset and mortgage-backed securities. The significant

that are not considered market observable. Certain private equity unobservable inputs used to value the following other asset and

investments and subordinated corporate fixed maturities, representing mortgage-backed securities are liquidity and weighting of credit

approximately 15% of securities included in Level 3, are valued at spreads. When there is limited trading activity for the security, an

transaction price in the absence of market data indicating a change in adjustment for liquidity is made as of the measurement date that

the estimated fair values. considers current market conditions, issuer circumstances and

complexity of the security structure. An adjustment to weight credit

spreads is needed to value a more complex bond structure with

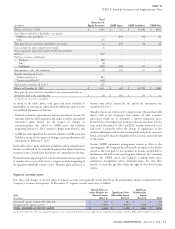

Quantitative Information about Unobservable Inputs multiple underlying collateral with no standard market valuation

technique. The weighting of credit spreads is primarily based on the

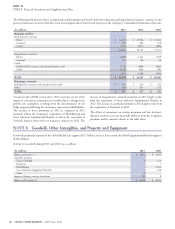

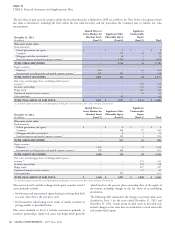

The following tables summarize the fair value and significant

underlying collateral’s characteristics and their proportional cash flows

unobservable inputs used in pricing Level 3 securities that were

supporting the bond obligations. The resulting wide range of

developed directly by the Company as of December 31, 2013 and

unobservable adjustments in the table below is due to the varying

2012. The range and weighted average basis point amounts reflect the

liquidity and quality of the underlying collateral, ranging from high

Company’s best estimates of the unobservable adjustments a market

credit quality to below investment grade.

participant would make to the market observable spreads (adjustment

to discount rates) used to calculate the fair values in a discounted cash

flow analysis.

Corporate and government fixed maturities. The significant unobservable input used to value the following corporate and government fixed

maturities is an adjustment for liquidity. When there is limited trading activity for the security, an adjustment is needed to reflect current market

conditions and issuer circumstances.

Unobservable Adjustment

to Discount Rates Range

Unobservable (Weighted Average) in

As of December 31, 2013

(In millions except basis points)

Fair Value Input Basis Points

Other asset and mortgage-backed securities $ 593 Liquidity 60 - 620 (170)

Weighting of credit spreads 120 - 2,090 (290)

Corporate and government fixed maturities $ 305 Liquidity 80 - 370 (200)

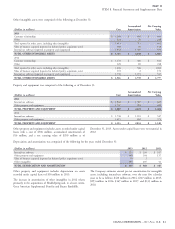

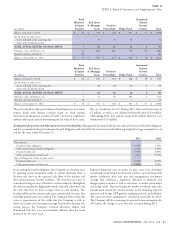

Unobservable Adjustment

to Discount Rates Range

Unobservable (Weighted Average) in

As of December 31, 2012

(In millions except basis points)

Fair Value Input Basis Points

Other asset and mortgage-backed securities $ 584 Liquidity 60 - 410 (140)

Weighting of credit spreads 50 - 4,540 (410)

Corporate and government fixed maturities $ 439 Liquidity 20 - 640 (190)

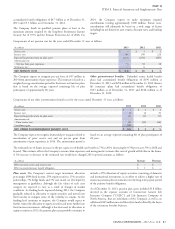

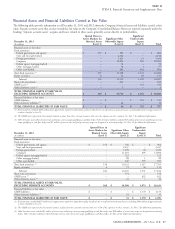

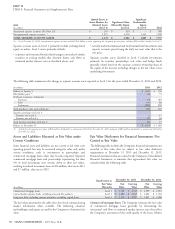

Significant increases in any of these inputs would result in a lower fair (b) the credit risk that the reinsurers do not pay their obligations

value measurement while decreases in these inputs would result in a (GMIB asset).

higher fair value measurement. Generally, the unobservable inputs are The Company reports GMIB liabilities and assets as derivatives at fair

not interrelated and a change in the assumption used for one value because cash flows of these liabilities and assets are affected by

unobservable input is not accompanied by a change in the other equity markets and interest rates, but are without significant life

unobservable input. The tables do not include Level 3 securities when insurance risk and are settled in lump sum payments. Under the terms

fair value and significant unobservable inputs were not developed of these written and purchased contracts, the Company periodically

directly by the Company, including securities using a single, receives and pays fees based on either contractholders’ account values

unadjusted non-binding broker quote and securities valued at or deposits increased at a contractual rate. The Company will also pay

transaction price. See the preceding discussion regarding the and receive cash depending on changes in account values and interest

Company’s valuation processes and controls. rates when contractholders first elect to receive minimum income

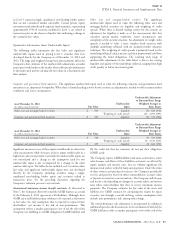

Guaranteed minimum income benefit contracts. As discussed in payments. The Company estimates the fair value of the assets and

Note 7, the Company effectively exited the GMIB business as a result liabilities for GMIB contracts by calculating the results for many

of the February 4, 2013 agreement with Berkshire. Although these scenarios run through a model utilizing various assumptions that

GMIB assets and liabilities must continue to be reported as derivatives include non-performance risk, among other things.

at fair value, the only assumption that is expected to impact future The non-performance risk adjustment is incorporated by adding an

shareholders’ net income is the risk of non-performance. This additional spread to the discount rate in the calculation of both (a) the

assumption reflects a market participant’s view of (a) the risk of the GMIB liability to reflect a market participant’s view of the risk of the

Company not fulfilling its GMIB obligations (GMIB liability) and

CIGNA CORPORATION - 2013 Form 10-K 89