Cigna 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

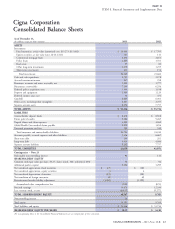

PART II

ITEM 8. Financial Statements and Supplementary Data

Cigna Corporation

Consolidated Balance Sheets

As of December 31,

(In millions, except per share amounts)

2013 2012

ASSETS

Investments:

Fixed maturities, at fair value (amortized cost, $15,273; $15,481) $ 16,486 $ 17,705

Equity securities, at fair value (cost, $146; $121) 141 111

Commercial mortgage loans 2,252 2,851

Policy loans 1,485 1,501

Real estate 97 83

Other long-term investments 1,273 1,255

Short-term investments 631 154

Total investments 22,365 23,660

Cash and cash equivalents 2,795 2,978

Accrued investment income 247 258

Premiums, accounts and notes receivable, net 1,991 1,777

Reinsurance recoverables 7,299 6,256

Deferred policy acquisition costs 1,395 1,198

Property and equipment 1,464 1,120

Deferred income taxes, net 92 374

Goodwill 6,029 6,001

Other assets, including other intangibles 2,407 2,355

Separate account assets 8,252 7,757

TOTAL ASSETS $ 54,336 $ 53,734

LIABILITIES

Contractholder deposit funds $ 8,470 $ 8,508

Future policy benefits 9,306 9,265

Unpaid claims and claim expenses 4,298 4,062

Global Health Care medical claims payable 2,050 1,856

Unearned premiums and fees 580 549

Total insurance and contractholder liabilities 24,704 24,240

Accounts payable, accrued expenses and other liabilities 5,456 6,667

Short-term debt 233 201

Long-term debt 5,014 4,986

Separate account liabilities 8,252 7,757

TOTAL LIABILITIES 43,659 43,851

Contingencies – Note 23

Redeemable noncontrolling interest 96 114

SHAREHOLDERS’ EQUITY

Common stock (par value per share, $0.25; shares issued, 366; authorized, 600) 92 92

Additional paid-in capital 3,356 3,295

Net unrealized appreciation, fixed maturities $ 473 $ 883

Net unrealized appreciation, equity securities 4 4

Net unrealized depreciation, derivatives (19) (28)

Net translation of foreign currencies 82 69

Postretirement benefits liability adjustment (1,060) (1,599)

Accumulated other comprehensive loss (520) (671)

Retained earnings 13,676 12,330

Less: treasury stock, at cost (6,037) (5,277)

TOTAL SHAREHOLDERS’ EQUITY 10,567 9,769

Noncontrolling interest 14 –

Total equity 10,581 9,769

Total liabilities and equity $ 54,336 $ 53,734

SHAREHOLDERS’ EQUITY PER SHARE $ 38.35 $ 34.18

The accompanying Notes to the Consolidated Financial Statements are an integral part of these statements.

CIGNA CORPORATION - 2013 Form 10-K 63