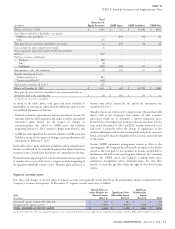

Cigna 2013 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2013 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

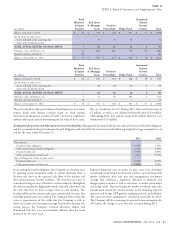

Fixed

Maturities &

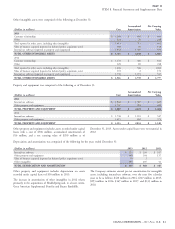

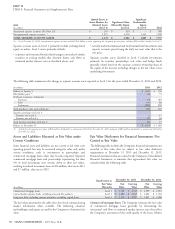

(In millions)

Equity Securities GMIB Assets GMIB Liabilities GMIB Net

Balance at January 1, 2012 $ 1,002 $ 712 $ (1,333) $ (621)

Gains (losses) included in shareholders’ net income:

GMIB fair value gain/(loss) – (55) 96 41

Other 13 – – –

Total gains (losses) included in shareholders’ net income 13 (55) 96 41

Gains included in other comprehensive income 8 – – –

Losses required to adjust future policy benefits for settlement

annuities

(1)

(10) – – –

Purchases, issuances, settlements:

Purchases 188 – – –

Sales (1) – – –

Settlements (88) (35) 67 32

Total purchases, sales, and settlements 99 (35) 67 32

Transfers into/(out of ) Level 3:

Transfers into Level 3 283 – – –

Transfers out of Level 3 (44) – – –

Total transfers into/(out of) Level 3 239 – – –

Balance at December 31, 2012 $ 1,351 $ 622 $ (1,170) $ (548)

Total gains (losses) included in shareholders’ net income attributable to

instruments held at the reporting date $ (1) $ (55) $ 96 $ 41

(1) Amounts do not accrue to shareholders.

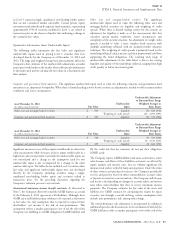

As noted in the tables above, total gains and losses included in income only reflect activity for the period the instrument was

shareholders’ net income are reflected in the following captions in the classified in Level 3.

Consolidated Statements of Income: Transfers into or out of the Level 3 category occur when unobservable

Realized investment gains (losses) and net investment income for inputs, such as the Company’s best estimate of what a market

amounts related to fixed maturities and equity securities and realized participant would use to determine a current transaction price,

investment gains (losses) for the impact of changes in become more or less significant to the fair value measurement. For the

non-performance risk related to GMIB assets and liabilities years ended December 31, 2013 and 2012, transfers between Level 2

beginning February 4, 2013, similar to hedge ineffectiveness; and and Level 3 primarily reflect the change in significance of the

unobservable inputs used to value certain public and private corporate

GMIB fair value (gain) loss for amounts related to GMIB assets and bonds, principally related to liquidity of the securities and credit risk

liabilities, except for the impact of changes in non-performance risk of the issuers.

subsequent to February 4, 2013.

Because GMIB reinsurance arrangements remain in effect at the

In the tables above, gains and losses included in other comprehensive reporting date, the Company has reflected the total gain or loss for the

income are reflected in net unrealized appreciation (depreciation) on period as the total gain or loss included in income attributable to

securities in the Consolidated Statements of Comprehensive Income. instruments still held at the reporting date. However, the Company

reduces the GMIB assets and liabilities resulting from these

Reclassifications impacting Level 3 financial instruments are reported

reinsurance arrangements when annuitants lapse, die, elect their

as transfers into or out of the Level 3 category as of the beginning of

benefit, or reach the age after which the right to elect their benefit

the quarter in which the transfer occurs. Therefore gains and losses in

expires.

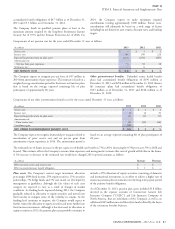

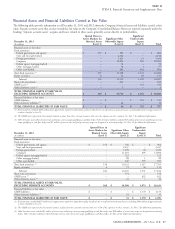

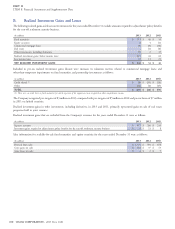

Separate account assets

Fair values and changes in the fair values of separate account assets generally accrue directly to the policyholders and are excluded from the

Company’s revenues and expenses. At December 31, separate account assets were as follows:

Quoted Prices in Significant

Active Markets for Significant Other Unobservable

Identical Assets Observable Inputs Inputs

2013

(In millions)

(Level 1) (Level 2) (Level 3) Total

Guaranteed separate accounts (See Note 23) $ 264 $ 284 $ – $ 548

Non-guaranteed separate accounts

(1)

1,844 4,825 1,035 7,704

TOTAL SEPARATE ACCOUNT ASSETS $ 2,108 $ 5,109 $ 1,035 $ 8,252

(1) As of December 31, 2013, non-guaranteed separate accounts included $3.8 billion in assets supporting the Company’s pension plans, including $983 million classified in Level 3.

CIGNA CORPORATION - 2013 Form 10-K 91

•

•