Cigna 2013 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2013 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

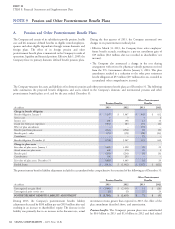

Pension and Other Postretirement Benefit Plans

The Company and certain of its subsidiaries provide pension, health During the first quarter of 2013, the Company announced two

care and life insurance defined benefits to eligible retired employees, changes to its postretirement medical plan:

spouses and other eligible dependents through various domestic and Effective March 31, 2013, the Company froze active employees’

foreign plans. The effect of its foreign pension and other future benefit accruals, resulting in a pre-tax curtailment gain of

postretirement benefit plans is immaterial to the Company’s results of $19 million ($12 million after-tax recorded in shareholders’ net

operations, liquidity and financial position. Effective July 1, 2009, the income).

Company froze its primary domestic defined benefit pension plans.

The Company also announced a change in the cost sharing

arrangement with retirees for pharmacy subsidy payments received

from the U.S. Government effective January 1, 2014. This plan

amendment resulted in a reduction to the other post retirement

benefit obligation of $57 million ($37 million after-tax, recorded in

accumulated other comprehensive income).

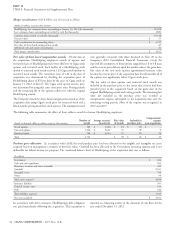

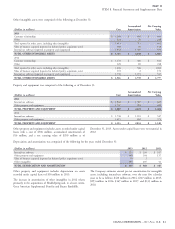

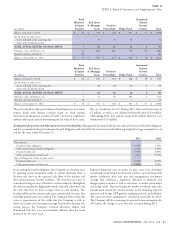

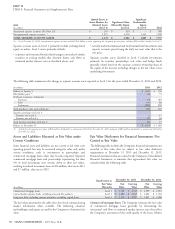

The Company measures the assets and liabilities of its domestic pension and other postretirement benefit plans as of December 31. The following

table summarizes the projected benefit obligations and assets related to the Company’s domestic and international pension and other

postretirement benefit plans as of, and for the year ended, December 31:

Other Postretirement

Pension Benefits Benefits

(In millions)

2013 2012 2013 2012

Change in benefit obligation

Benefit obligation, January 1 $ 5,267 $ 5,067 $ 442 $ 452

Service cost 3 312

Interest cost 181 198 12 16

(Gain) loss from past experience (464) 283 (37) (2)

Effect of plan amendment – – (57) –

Benefits paid from plan assets (262) (256) (3) (3)

Benefits paid – other (25) (28) (28) (23)

Curtailment – – (7) –

Benefit obligation, December 31 4,700 5,267 323 442

Change in plan assets

Fair value of plan assets, January 1 3,665 3,298 20 22

Actual return on plan assets 488 370 (1) 1

Benefits paid (262) (256) (3) (3)

Contributions 198 253 – –

Fair value of plan assets, December 31 4,089 3,665 16 20

Funded Status $ (611) $ (1,602) $ (307) $ (422)

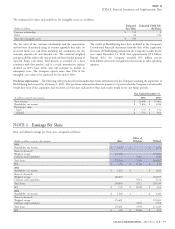

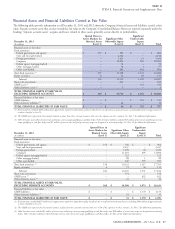

The postretirement benefits liability adjustment included in accumulated other comprehensive loss consisted of the following as of December 31:

Other Postretirement

Pension Benefits Benefits

(In millions)

2013 2012 2013 2012

Unrecognized net gain (loss) $ (1,696) $ (2,450) $ 14 $ (28)

Unrecognized prior service cost (5) (5) 57 23

POSTRETIREMENT BENEFITS LIABILITY ADJUSTMENT $ (1,701) $ (2,455) $ 71 $ (5)

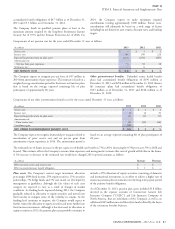

During 2013, the Company’s postretirement benefits liability investment returns greater than expected in 2013, the effect of the

adjustment decreased by $830 million pre-tax ($539 million after-tax) plan amendment described above, and amortization.

resulting in an increase to shareholders’ equity. The decrease in the Pension benefits. The Company’s pension plans were underfunded

liability was primarily due to an increase in the discount rate, actual by $0.6 billion in 2013 and $1.6 billion in 2012 and had related

82 CIGNA CORPORATION - 2013 Form 10-K

NOTE 9

A. Pension and Other Postretirement Benefit Plans

•

•