Aviva 2009 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2009 Aviva annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

07

100

200

300

100

400

Performance review

Aviva plc Group strategy continued

Corporate responsibility

Annual Report and Accounts 2009

Governance

Shareholder information

Financial statements IFRS

Financial statements MCEV

Other information

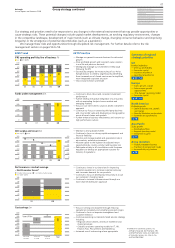

Our strategy and priorities need to be responsive to any changes in the external environment that may provide opportunities or

cause strategic risks. These potential changes include capital market developments, an evolving regulatory environment, changes

in the competitive landscape, development of major trends (such as climate change, changing consumer behaviour and improving

longevity) or the emergence of potential discontinuities (such as a pandemic).

We manage these risks and opportunities through disciplined risk management. For further details refer to the risk

management section on pages 56 to 59.

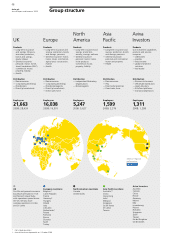

Summary of regional

strategic priorities

UK

Market leadership

— Drive up profitability

— Generate capital

— Insurance excellence

— Operational excellence

l 12 – 13

Europe

— Scale, growth, capital

— Seize unique growth

opportunities

— ‘One Europe’ operating model

— Generate capital

l 14 – 15

North America

Profitable growth

— Optimise business mix, growth

and margin

— Diversify distribution and products

— Generate net capital returns

l 16

Asia Pacific

Scale, growth

— Prioritised portfolio

— Regional operating model

— Investment required

l 17

Aviva Investors

— Globally integrated business

— Transform the investment model

— Increase third party business

l 18

2009 Trend 2010 Priorities

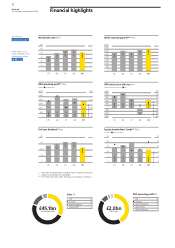

IFRS operating profit by line of business %

— Manage our general insurance business for value and

FM

growth

Life GIH

— Drive profitable growth and long-term value creation

80

61 5

53 5

37 6

40 4

32 5

60

40

57

56

63

20

34

42

0

in our life and pensions business

— Strategically manage our investment in Delta Lloyd

following the IPO

— Successfully progress the restructuring of our Aviva

Europe division to create a single business benefiting

from increased use of shared services and a simplified,

more integrated corporate structure

— Grow Aviva Investors worldwide

05 06 07 08 09

Funds under management £m

— Continue to drive robust and consistent investment

performance

— Further develop the global integration of our business

with an expanding footprint across mature and

100

335

349

359

304

across all asset classes and markets

— Further enhance business effectiveness and nurture our

0

high performance culture

06 07 08 09

IGD surplus and cover £bn

— Maintain a strong balance sheet

Cover

— Continue to focus on strong capital management and

financial flexibility

IGD surplus

5.0 2.0

— Monitor and manage market and operational risks in

1.6

an uncertain, external environment

4.0

— Allocate capital to the highest risk-adjusted return

emerging markets

— Focus on our client-centric solutions driven investment

approach

— Continue our focus on attracting third party business

and cross border sales and developing a strong pipeline

3.0 1.2

s)

2.0 0.8

r (time

1.0 0.4

d cove

0

3.5

3.5

2.9

2.0

0

Dividen

4.5

opportunities by country, product and business line

— Participate actively in all consultations with European

regulators to develop an appropriate outcome for

Solvency II regulations

05 06 07 08 09

Performance v market average

–

Net Promoter Score

©

% below market average % at or above market average

% in upper quartile

80

60

40

20

0

— Continue to invest in our brand and in improving

customer experience to increase customer advocacy

and consumer demand for our products

— Continue to focus on developing new products to suit

our customers’ changing needs

— Continue to increase customer access through our

multi-channel distribution approach

08 09

Cost savings £m

— Focus on strong cost discipline through reducing

operational complexity and simplifying product ranges

600

— Continue to focus on expense management and

customer retention

35

500 Target: £500m

340

170

545

Finance, Risk, Procurement and Marketing © 2006-2010 Satmetrix Systems, Inc.

100

All Rights Reserved. Net Promoter, NPS

and Net Promoter Score are trademarks

— Increased use of outsourcing where appropriate

0

of Satmetrix Systems Inc., Bain & Co.,

Achieved Achieved Expected Total

and Fred Reichheld

to 2008 in 2009 in 2010

— Continue executing our tailored shared services strategy

including:

– Regional service centres, centres of excellence and

shared processes

– Globally consistent operating models for IT, HR,

200

400

300