Aviva 2009 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2009 Aviva annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

Performance review

Aviva plc Aviva UK continued

Annual Report and Accounts 2009

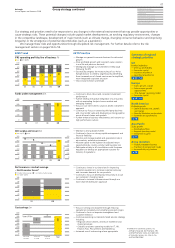

Long-term and savings operating profit £m

MCEV* IFRS

09

672

787

08

751

883

07 822

723

06 744

629

05 589

327

* On an MCEV basis from 2007. Prior years presented on an EEV basis.

UK general insurance business

Market environment

2009 has been a challenging year, with strong competition and

the recession impacting all lines of business. More customers

are searching for cheaper deals, while fewer are making

discretionary purchases such as breakdown cover. A significant

fall in creditor volumes, resulting from lower lending, was

compounded by a sharp rise in creditor claims. Fewer start-ups,

more business failures and reduced exposures have resulted in

shrinking commercial markets. However, there have been some

recent encouraging signs that more realistic pricing is emerging

in the market, particularly in personal motor.

Performance

The UK general insurance operation has significantly improved

the profitability of business written in 2009. By simplifying the

business, reducing costs, achieving scale benefits and taking a

disciplined approach to underwriting and distribution, we have

created a platform for future growth.

Progress on our transformation programme remains ahead

of plan, with all business now being undertaken in our new

‘centres of excellence’. We are on track to deliver annualised

savings of more than our £150 million target from this phase by

2010, in addition to savings of £200 million already delivered.

We have refocused our brands to offer our customers the

best price when they buy direct from Aviva supported by our

‘Get the Aviva Deal’ marketing campaign, complemented by

the RAC panel which is available on all major online price

comparison sites and supported by 17 insurers. The impact has

been extremely positive: we sold more direct personal motor

policies in the fourth quarter than in the same period in the

previous three years and the RAC panel had gained a share of

around 3.5% of new business in the UK personal motor market

by the end of 2009.

Overall business volumes have fallen reflecting the action

we have taken to exit unprofitable business and the challenging

market conditions. We continue to support independent brokers

through a range of initiatives including customised networks

(such as the Broker Independence Group and Club 110) as well

as providing easy and fast access to our best prices. In addition,

we were delighted to renew the Barclays homeowner account.

Outlook

In the general insurance market, quality of earnings remains our

priority and we aim to increase profitability through enhanced

risk selection and tightly controlling our costs. Whilst there are

some encouraging signs in personal motor, we continue to see

intense competition in many segments of the market and we

await the significant shift in attitude that the market requires.

Corporate responsibility

Governance

Shareholder information

Financial statements IFRS

Financial statements MCEV

Other information

This is particularly true in the case of Commercial lines and there

is little evidence that the market is hardening significantly.

RAC insurance

RAC continues from strength to strength as a leading UK service

brand, coming fifth in the Institute of Customer Service’s 2009

survey, comparable with John Lewis, Waitrose and M&S. In its

core breakdown category it won the JD Power survey for an

unprecedented fourth consecutive year. The service culture is

not just delivered by our patrol staff either: RAC’s membership

call centre entered the Times Top 50 UK call centres at 14th.

In January 2009 we launched our car insurance panel under

the iconic RAC brand to complement our existing direct offering

from Aviva. This ensures that almost every customer that calls us

can be provided cover at competitive prices. The panel is on all

the major online price comparison sites and it is writing growing

volumes of business through this channel of distribution.

General insurance and health net written premiums £m

09 4,298

08 5,413

07 5,897

06 6,000

05 6,127

General insurance and health IFRS operating profit £m

COR

1,200 108

960 104

100

720

96

480

92

240

0 88

%

05 06 07 08 09

Performance review