Aviva 2009 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2009 Aviva annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

Performance review

Aviva plc Asia Pacific

Annual Report and Accounts 2009

Committed to building a high-

growth and value-creating region

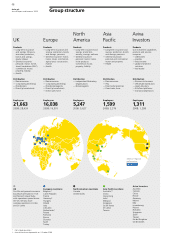

We operate in eight countries across the Asia

Pacific region through both joint ventures and

wholly-owned operations. India and China,

both with large populations and relatively high

economic growth, are ‘must-win’ markets

capable of generating a significant proportion

of our future expansion within Asia. Throughout

the rest of the region, our focus is on developing

the strength of our bancassurance business with

joint venture partners.

Strategy

Our ambition is to build a high growth and value-creating

region driven by the ‘must-win’ markets of China and India.

We will achieve this by:

— securing strong organic growth across all our markets

— leveraging our multi-distribution platforms and core

capabilities in bancassurance

— exploring new growth opportunities in particular health

and general insurance

— expanding our regional footprint in fast-growing, high

potential insurance markets

— investing in the Aviva brand.

Market environment

Trading conditions were difficult in 2009. Long-term savings

sales were affected by the economic climate as investors turned

to low volatility investments such as bank deposits. The industry

also experienced an increase in lapses and clients exercising

their premium holiday options.

Performance

Total sales were £2,712 million in 2009, down 22% on 2008.

IFRS operating profit for the year improved 114% to £77 million

reflecting the improved long-term and savings result. Our

financial results are discussed in more detail on page 48 of

this report.

During 2009, customers’ increased caution has led to

a growing demand for protection and health products and

those savings products with guarantee features. We have

strengthened our proposition in these areas which, together

with our investment product capabilities, will enable us to

harness the expected economic rebound.

We made substantial efforts to conserve capital and control

costs, reducing the sale of capital intensive products in Hong

Kong, Malaysia and Taiwan and implementing a region-wide

cost-reduction programme. The sale of our Australian business

in October also realised a £0.4 billion contribution to capital.

As part of our commitment to achieving ‘One Aviva, Twice

the Value’, we launched a number of new initiatives in the

region. These included our wrap platform in Hong Kong and

new protection, savings and investment products, both

conventional and Takaful (Islamic insurance), in Malaysia

through our shared services platform.

We expanded our customer reach in local markets during

the year with a particular focus on bancassurance: we renewed

our partnership with DBS Bank in Singapore and Hong Kong

until 2015, extended to additional markets in India, China and

Taiwan, and also agreed extended terms with key partners in

Corporate responsibility

Governance

Shareholder information

Financial statements IFRS

Financial statements MCEV

Other information

India. We opened our tenth provincial branch in China, ahead

of our 2010 target; achieved encouraging sales through Woori

Bank in South Korea and opened 13 new branches around the

Seoul area.

Outlook

Looking forward, we expect recovery in Asia Pacific to be ahead

of other regions. Prospects for 2010 are more optimistic with

the Asia Development Bank predicting GDP growth of 6.6%

for emerging Asia versus 4.3% in 2009. We are committed

to building a high-growth and value-creating region and

establishing Aviva as a leading international player in Asia.

Joint venture in Malaysia

We signed a joint venture partner deal with CIMB, the second

largest bank in Malaysia in 2007 to capitalise on its distribution

network by providing market leading insurance products and

excellent servicing capability. To achieve this we drew on our

regional shared services capability and technical infrastructure

in Singapore to deliver and administer the product set. We

successfully launched a portfolio (EasyLife Solutions) of 10

investment-linked products within a six-month timeframe.

Sales of EasyLife Solutions have gone from strength to strength,

contributing to our position as fourth in the industry for single

premium business in 2009. This has also strengthened our

partnership with CIMB at all levels.

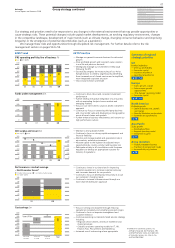

Total sales £m

09 2,712

08 3,499

07 4,283

06 3,059

05 1,990

Operating profit £m

MCEV* IFRS

09 86

77

08 69

36

07 101

37

06 92

50

05 89

15

* On an MCEV basis from 2007. Prior years presented on an EEV basis.

Performance review