Aviva 2009 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2009 Aviva annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

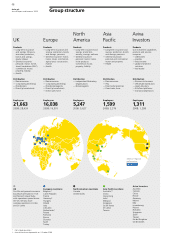

Aviva plc Aviva UK

Annual Report and Accounts 2009

A leader in our home market

From 1 January 2010 we have brought together

the Aviva UK life and general insurance

businesses, creating a new organisation led by

one chief executive officer. In 2009, in addition

to completing the rebranding to Aviva, both

businesses have continued their extensive

transformation programmes, which will make

significant improvements to customer service,

and they have delivered combined cost savings

of £450 million, a year ahead of plan.

Strategy

Our core strategies for the UK business are:

— to leverage our extensive distribution network and customer

base to increase profits in a mature but evolving marketplace

— to maintain market leadership through balanced distribution

and broad product mix, improved customer retention and

the simplification of processes, services and costs

Aviva UK

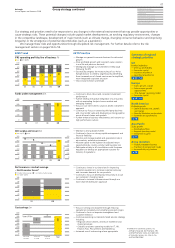

Total sales were £14,261 million in 2009, down 24% on

2008. IFRS operating profit for the year decreased 15% to

£1,165 million reflecting the impact of lower premiums and

lower investment returns. These results are discussed in more

detail on page 44 of this report.

The rebrand to Aviva in the UK took place on 1 June 2009.

Our successful advertising campaigns, highlighting Aviva’s

products and services and encouraging customers to ‘get the

Aviva deal’, have increased recognition and awareness of the

Aviva brand significantly.

UK life business

Market environment

During 2009 the overall long-term savings market declined by

17%1. This contraction, for the second consecutive year, was

primarily driven by falls in the pension and bond markets as

lower consumer confidence, limited salary increases and higher

unemployment reduced customers’ propensity to save and

invest for the future. Specific regulatory events, such as the

cessation of sales of single premium creditor business, also

impacted the market. Despite this, we have maintained a

disciplined focus on profitability, significantly improving our

new business margin.

Performance

In the UK life market, Aviva has built a leading position across

a broad product range. We have gained competitive advantage

through our financial strength, product development and taking

actions to simplify the business making it easier for customers.

We delivered new propositions recognising consumer

needs, including offering 12-months, free life cover to new

parents, the launch of a With-Profit Guaranteed bond and

recently re-opening our Wrap and Sipp platforms to new

business. Our innovative Simplified Life protection product

continues to go from strength to strength with a 147% increase

in new applications compared to 2008, whilst our market-

leading individual annuity pricing capability attained record new

business volumes for this product in the fourth quarter of 2009.

1 Source: Association of British Insurers (ABI)

As a result of our major simplification and efficiency initiatives,

designed to better meet customer needs, we have outsourced

the administration of almost three million policies to industry

experts: Swiss Re, Scottish Friendly and International Financial

Data Services. We have decommissioned over 300 IT systems,

delivered a more flexible cost base and made £100 million of

annualised cost savings.

We have continued to invest in our e-commerce offerings

with the launch of further new propositions to help our

customers and distribution partners. ‘Customer Portal’ and

‘Aviva for Advisers’ provide secure online access to over

4.5 million policies, enabling customers and advisers to manage

their Aviva life products quickly and easily at a time convenient

to them. We were also the first in the industry to offer a virtual

online guide as part of our innovative ‘Pension Tracker’, making

it possible for almost 1.5 million customers to manage their

Aviva pension plans online. This approach contributed to Aviva

winning the Personal Finance ‘Pension Provider of the Year’

award voted for by customers and judged on proposition

quality, brand, service and sustainability.

Throughout 2009 our commitment to deliver service

excellence has driven improved satisfaction and advocacy

results. By listening to and understanding what matters most

to our customers and distributors, we can ensure they have

a better service experience.

Outlook

We expect the market to remain challenging in the short term

as the impact of the recession continues to influence demand

for investment and savings products. Longer term, major

regulatory changes including the Retail Distribution Review

and Solvency II will be implemented. Our strategies will enable

us to exploit the opportunities emerging in our market as we

continue to build on our e-commerce and service capability and

product and distribution breadth.

Fair reattribution payments

Following the announcement in May 2009 of a new, more

flexible offer – and the subsequent FSA and High Court

approval in September – the reattribution of our inherited

estate completed on 1 October. Our objective was always to

create a reattribution that was fair to both shareholders and

policyholders, making sure that customers had a choice of

whether they wished to accept the offer, depending on their

personal circumstances. As a result, over 87% of eligible

policyholders voted during the election process, with 96% of

these voting in favour of the offer. By the end of 2009, the

majority of the £471 million reattribution payment had been

distributed to those policyholders who accepted the offer.

Long-term and savings sales £m

09 9,963

08 13,343

07 14,548

06 13,812

05 10,345