Aviva 2009 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2009 Aviva annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

05

Aviva plc Group chief executive’s review continued

Annual Report and Accounts 2009

Q How has Aviva performed throughout

a difficult 2009?

Like all financial services companies, we have

been affected adversely, both by market

volatility and understandable customer caution.

However, the business has stood up well. This

is due, in part, to our global diversity, having

both life and general insurance operations and

also because of the decisive action we have

taken through the strategy put in place two

years ago.

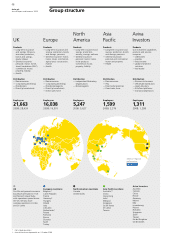

Several months into 2010, we have made

great progress in transforming our UK business

under one team. We are also starting to see

positive results from the creation of our ‘one

Europe’ operating model. In North America, the

life market has been really challenged and it’s

good to see that coming back. In Asia Pacific,

despite customers being cautious, we have

continued to grow our business, particularly

in China and South Korea. Aviva Investors’

investment performance has radically improved

along with solid earnings.

Q How financially strong

is Aviva?

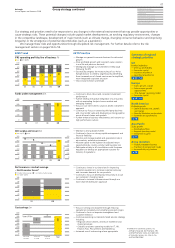

We’ve seen a marked improvement in our

capital position. Focusing on costs in order to

improve margins has meant that, whilst we have

seen volumes drop, we still reported a resilient

operating profit and a strong balance sheet.

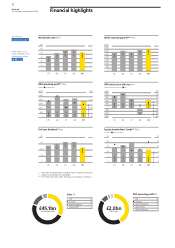

We have worldwide sales of £45 billion and

£379 billion of funds under management.

We are managing our financial risks prudently

and skilfully.

Q Why did you cut your dividend

mid-year?

In light of Aviva’s lower IFRS operating

earnings, the continuing economic uncertainty

and our desire to retain flexibility, we felt it was

the right decision to make. So in spite of it

being a tough decision, we believe it was the

right one.

Q Do you remain committed to your

‘One Aviva, Twice the Value’ strategy?

We have made good progress towards our

target this year. If you compare earnings per

share of 37.8 pence in 2009 with those of

2008 (a loss of 36.8 pence), it's a great

improvement.

In the past 12 months we’ve increased the

pace of transformation and restructured our

portfolio, giving us new opportunities to

redeploy capital to support profitable growth.

Our senior management team is committed to

this target and it remains our focus in 2010.

Performance review

Corporate responsibility

Governance

Shareholder information

Financial statements IFRS

Financial statements MCEV

Other information

Q How is your business

changing?

In 2008 we initiated a programme to create

a simplified and more modern way of doing

business to improve efficiency and reflect

customers’ preference to do business online;

we’ve invested in new technology and

streamlined our processes.

This fundamental change in the way we

operate means our business is now fit for

the future, with improved capacity and

productivity. We have reduced our costs by

£500 million and Aviva has 19% fewer

employees than two years ago.

What's really pleasing is that during this

period our customer satisfaction has improved,

with nearly 70% of our businesses at or above

the local market benchmark and 50% are in

the upper quartile.

Q What are you most proud of

in 2009?

I'm most proud of our people: their dedication

and resilience over the past year has been

incredible. They've remained focused on what

we're here for – delivering prosperity and peace

of mind to our customers – and have done a

great job.

I’ve already talked about our financial

strength and the strategically significant

achievements in our business. However, none

of this could have been done without the hard

work of all of our people around the world.

Looking forward – how would you

Q sum up your priorities for 2010?

There’s no question that the economic climate

remains uncertain: 2010 is still challenging but

I’m confident we have the right team, strategy

and commitment to make it another successful

year. We will continue to deliver our strategy,

maintain our capital strength and focus on the

profitable growth of our company.

53 million customers place their business

with us. That’s a great responsibility and we

will be working harder than ever in 2010 to

continue to earn their trust and attract new

customers to Aviva.

Andrew Moss

Group chief executive