Aviva 2009 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2009 Aviva annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

Aviva plc North America

Annual Report and Accounts 2009

Poised to benefit from recovery in

the world’s wealthiest market

The North American marketplace provides us with

access to a strategically attractive population with

a growing demand for products that offer

prosperity and peace of mind in both the general

insurance and life and annuities marketplaces.

Strategy

We will continue to grow our existing businesses and raise

our profile in North America on the back of the strength of

the global brand, communicating with financial analysts, key

financial and business media, consumers and distributors.

Our strategic priorities for the region are:

— to enhance capital efficiency and optimise margins

— to selectively expand and grow our core life insurance

and annuity distribution and product capabilities

— to operate as a great underwriting company

— to make best use of the synergies created within the regional

operating model

— to enhance strong and valuable relationships with our

customers and distributors.

Market environment

The US economy, and its financial sector in particular, suffered

a severe contraction as a result of the financial crisis. The

recession also had a major impact on Canada, the US’ largest

trading partner. There are now increasing signs of economic

recovery and, despite the recession, North America’s economies

remain among the world’s largest and its population among

the world’s wealthiest.

Performance

Total sales were £6,345 million in 2009, down 13% on 2008.

IFRS operating profit for the year improved 43% to £213 million

reflecting the improved long-term and savings result. Our

financial results are discussed in more detail on page 47 of

this report.

In our US business we have deliberately moderated annuity

sales in comparison to the prior year and centred on capital

management. We have grown our life insurance portfolio,

outperforming in a market that contracted by 19% in the

first nine months of the year.

In the Canadian business we have focused on initiatives

that improve our operational and underwriting effectiveness.

Examples include the implementation of our three-company

model, enabling us to price the auto business in the heavily

regulated Ontario market more accurately, and enhanced

underwriting through the use of more standardised and

automated processes. Elsewhere the Canadian business has

seen an unusually high frequency of large losses through

a combination of commercial fires and Ontario personal

auto claims.

As part of the ‘One Aviva, Twice the Value’ strategy, we

are consolidating each of our non-market-facing functions

into single North American business areas giving us improved

capability at lower cost.

Outlook

A number of economic indicators are starting to point to a

steady recovery in 2010. We will continue to grow our life

insurance portfolio in the US and our contribution to total Aviva

profits, building on 2009 successes. We await the outcome of

the SEC151A debate concerning the future regulation of

annuity products and will respond appropriately. In Canada we

will further enhance our underwriting processes to improve risk

selection, profitability and capital efficiency.

Innovative pricing

In the Canadian business we have successfully implemented

an innovative approach to the pricing of personal property

business known as ‘Rate by Peril’. We have used a detailed

and sophisticated mapping approach combined with proprietary

and public information to deconstruct the blended approach

to pricing used for multi-peril household policies. Using this

approach we are able to determine a unique rate for each

individual property reflecting its unique exposure to the perils

covered by the policy including fire, water damage, wind-storm,

sewer back-up, theft and liability. The increased pricing

precision that we are able to apply enables us to ‘right-price‘

each property.

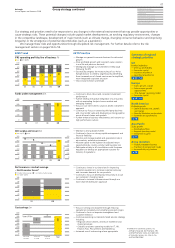

Total sales £m

General insurance Long-term savings

09 6,345

08 7,316

07 5,058

06 2,284

05 1,851

Operating profit £m

MCEV* IFRS

09 394

213

08 334

149

07 274

229

06 180

161

05 172

158

* On an MCEV basis from 2007. Prior years presented on an EEV basis.