Aviva 2009 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2009 Aviva annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328

|

|

04

Aviva plc Group chief executive’s review

Annual Report and Accounts 2009

Andrew Moss

Group chief executive

Read more about

our strategy

l 06 – 07

Read more about

how our regions

are performing

l 12 – 18

Listen to Andrew discuss

our year in our new

online review

Visit Aviva at

www.aviva.com

A year of significant

progress

I’m pleased with our progress this year. It has been a year of

strong financial performance and delivery against our strategic

plans. I’m proud of the way my team has performed and I’m

confident that by remaining focused on our strategy we will

make further progress in 2010.

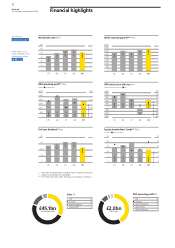

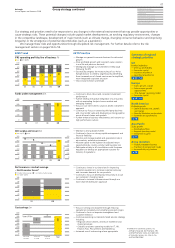

Aviva has delivered a strong return to profit with IFRS total profit after tax at

£1,315 million. On an MCEV basis, which takes into account the long-term nature

of life insurance business, the total profit after tax was £2,935 million compared to

a loss of £7,707 million in 2008. This rebound in total profits reflects the combined

effects of a recovery in equity markets, together with our disciplined business

management and cost control. Operating profit is 12% lower at £2,022 million

on an IFRS basis and up 3% on an MCEV basis to £3,483 million.

We have strengthened Aviva’s capital position substantially over the past year

and IGD solvency surplus, the buffer we hold above our liabilities, has more than

doubled to £4.5 billion reflecting some bold capital management initiatives and

a recovery in investment markets.

We have made excellent progress in the delivery of our strategy, including our

move to a single brand, the IPO of our Dutch business, the reattribution of the

inherited estate in the UK and the restructuring of our cost base.

In driving Aviva forward, we will retain our disciplined approach. We expect the

external environment to remain unpredictable for some time but are encouraged

that we saw the first signs of an improved appetite to save among our customers

in the final quarter of last year.

We will continue to deliver against the strategy that has helped us to navigate

the global economic crisis so successfully. We will maximise the value of being a

single, global group, as we aim to deliver a consistently positive experience for our

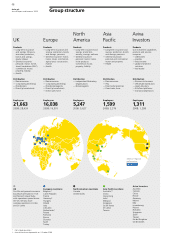

53 million customers around the world.

Progress

Creating a global brand has been the most visible sign of ‘One Aviva’ so far.

We're working hard to ensure it's much more than a name change.

We're making progress towards delivering ‘twice the value’ – improving the

way we serve our customers, increasing our efficiency, focusing on profitability,

removing cost from the business and delivering strong results.

Regions

— Successful rebrand to Aviva in the UK

— Integrating 12 of our businesses in Europe

— Life assurance portfolio outperforms market in North America

— Expanded customer reach in Asia Pacific through new bancassurance deals

— Improved investment and earnings performance for Aviva Investors

Highlights

— Improved financial strength with IGD solvency more than doubled in 2009

— Successful partial sale of Delta Lloyd in the Netherlands for £1 billion

— Sale of Australian life business

— £471 million paid to policyholders from reattribution of inherited estate