Aviva 2009 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2009 Aviva annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

06

Aviva plc Group strategy Our purpose is to deliver prosperity and

peace of mind to our customers. We will do

this by realising our vision: ’One Aviva, Twice

the Value’.

Annual Report and Accounts 2009

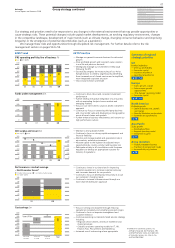

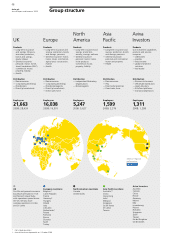

In support of our purpose and our ‘One Aviva, Twice the Value’ vision, Aviva provides a composite portfolio of life and pensions,

general insurance, health insurance and asset management products through a multi-channel distribution approach. Working

together across regions under one Aviva brand provides greater financial stability and flexibility through diversification and a

reduced reliance on any one channel, product, country or customer group.

Progress on our current strategic priorities is set out below.

Our strategic priorities

Manage composite portfolio

We are fully committed to maintaining the composite nature

of the group. We firmly believe in the benefits of life

insurance, general insurance and asset management as

complementary parts of an overall business model that

balances cashflow, returns and long-term value creation, and

delivers prosperity and peace of mind to customers.

Build global asset management

Launched in September 2008, Aviva Investors is a clear example

of the ‘One Aviva, Twice the Value’ strategy in action. Integrating

our global asset management businesses under one umbrella,

Aviva Investors is now a leading asset manager, with offices in 15

countries and £250 billion of funds under management. We plan

to continue to grow Aviva Investors and significantly increase its

contribution to group profits.

Progress 2009

Active management of our composite model provided us with strength in a

challenging environment, specifically:

— Focused on profitability above sales volume by exercising price discipline and

leadership in general insurance and by increasing margins and driving long-term

value creation in life and pensions

— Robust performance in Europe benefiting from our strong bancassurance

relationships despite the challenging environment with excellent sales

performance in Italy (55%) and France (26%)

— Strengthened our position in Asia through strong growth in China (15%) and

Korea (93%). Withdrew capital intensive products in Hong Kong and Taiwan

— Brought UK life and general insurance businesses together under a single

management team

— Grew Aviva Investors worldwide (see below)

— Achieved robust investment performance across all key markets around the globe

— Experienced positive net flows of £2.4 billion from third party clients in difficult

market conditions

— Enhanced our global distribution and manufacturing capability

— Made significant progress in building a truly global business development

capability and achieved a strong sales pipeline across a range of asset classes

and markets

— Achieved top quartile ranking in the most recent UK Greenwich Quality Index

measuring client service and investment performance

Allocate capital rigorously

Capital management will continue to be a key focus. Capital

is treated as a scarce resource, and is allocated to provide the

highest sustainable returns for shareholders. We continuously

seek improvements in capital structure and efficiency.

Strengthened our capital position through a combination of successful strategic

initiatives and disciplined capital and balance sheet management including:

— Robust underlying earnings rebuilding our capital base

— IPO of Delta Lloyd in the Netherlands

— Sale of Australian business

— Reattribution of inherited estate in UK

Multi-channel customer reach

We sell our products in 28 countries in ways that our

customers choose to buy them. We will get closer to our

customers through better understanding of their needs and

by providing products and services that customers want.

We will continue looking for the right distribution in the

right markets.

Boost productivity

We constantly look for ways to boost our productivity, to

support sustainable growth, increase our competitiveness,

improve our services, and deliver higher value to our

customers. Working together as ’One Aviva‘, we deliver

operational excellence through shared services, shared

knowledge, rationalised systems and effective outsourcing.

— Implemented initiatives to improve the customer experience and support the

Aviva brand overall (such as introducing the Aviva Customer Cup to promote

customer focused projects)

— Expanded our distribution reach through renewal of DBS bancassurance

agreement which now extends to markets such as China and India

— Successfully carried out our major rebrand campaign in the UK creating a

significant increase in spontaneous awareness among consumers

— Invested in our e-commerce capability in the UK with the launch of Aviva for

Advisers website and made our online pension tracker proposition available to

over 1 million customers

— Created further value from our leading and unique bancassurance franchise in

Aviva Europe with sales growth of 14% in 2009

— 50% of all business units participating in our annual benchmarked relationship

survey were ranked upper quartile by customers when compared to local

market averages

— Achieved £510 million of cost savings against £500 million target including

reducing total headcount from 54,000 in 2008 to 46,000 in 2009

— Developed a leaner ‘One Aviva’ operating model through:

– Increased use of regional shared services in all regions

– Implementation of centres of excellence in technology

– Outsourced part of the UK Life book to Swiss Re, outsourced IT data centres

in UK and Canada and transferred UK Life Lifetime and Collectives

administration to Scottish Friendly and IFDS, respectively