Aviva 2009 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2009 Aviva annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

Aviva plc Europe

Annual Report and Accounts 2009

Building a truly pan-European

business with a broad and

diverse portfolio

We have a clear strategy to exploit the

considerable opportunities in Europe. There

is significant growth potential in the region,

in both under-penetrated Western markets and

developing markets in Eastern Europe. With our

proven ability to operate across distribution

channels, we will be able to respond favourably

to market developments as customer confidence

begins to return.

Strategy

Our strategy is to capitalise on the significant opportunities

within Europe through:

— Aviva Europe’s Quantum Leap transformation plan,

creating one market leading pan-European business

from 12 federated businesses,

— the strategic development of our 58% investment in

Delta Lloyd following the IPO in November 2009.

Our principal financial objective is long-term, sustainable,

profitable growth.

Market environment

Europe is already the largest insurance market in the world with

an affluent population of over 800 million people, generating

31% of global insurance premiums1 and accounting for over

30% of global personal financial assets2. Europe offers

significant growth opportunities in both under-penetrated

Western markets and developing markets in Eastern Europe.

As elsewhere, the slowdown in economic growth has

impacted customer behaviour in the majority of the region

with customers favouring deposit bank accounts or guaranteed

insurance products. Customer confidence is beginning to return

particularly in France, Italy and Poland where customers are

starting to re-invest in more attractive insurance products such

as unit-linked bonds.

Aviva Europe performance

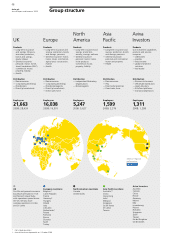

Aviva Europe operates in 12 businesses across Europe (excluding

the UK) with substantial operations in France, Italy, Ireland,

Poland and Spain. We also have a presence in the developing

markets in Central and Eastern Europe of Czech Republic,

Hungary, Lithuania, Romania, Russia, Turkey and Slovakia.

As part of our strategy, we are transforming our 12 federated

businesses through our Quantum Leap programme into one

market leading pan-European business.

1. Sigma (2008) – UK is excluded.

2. Aviva/Oliver Wyman research (2007) – UK is excluded.

3. Millward Brown Lansdowne study, Q3 2009.

4. Retail refers to the sale of insurance products outside of the bancassurance chanel through

our direct sales force, IFAs, brokers or internet sales.

Since January 2010, Aviva Europe has assumed responsibility

for developing Aviva’s business interests in the Middle East,

based in the United Arab Emirates. We expect this high-

potential market to grow, benefiting from Aviva Europe’s

experience and resources.

We achieved total sales of £16,258 million during 2009,

up 8% on 2008. IFRS operating profit for the year decreased

4% to £797 million, reflecting exceptional weather losses in

France and Ireland. These results are discussed in more detail

on page 45 of this report.

We have made significant progress in our migration to a

single Aviva brand. Having operated as Hibernian Aviva in 2009,

we adopted the Aviva name in Ireland at the start of 2010 and

we will complete our brand migration programme in June 2010

when we will operate as Aviva in Poland. Recognition of the

Aviva brand continues to grow in both markets, with Ireland

recording prompted awareness rates in excess of 90%3.

Our bancassurance franchise is the largest in Europe with

50 bank agreements and our retail4 channel accesses nine

million customers through 18,000 financial advisers. With this

proven ability to operate across distribution channels, we are

able to meet different customer preferences and respond

favourably to market developments.

Our business is performing strongly in both distribution

channels. In retail, our partnership with AFER, a leading savings

association in France, continues to be extremely successful

with customer numbers growing by 5% to 712,000 in 2009.

In bancassurance, our Italian partnership with Banco Popolare

that commenced in 2008 performed strongly in highly profitable

protection products, one of our key strategic objectives.

In 2009, we developed our suite of guaranteed products which

have proved attractive particularly in France, Spain and Italy.

Being there for customers in times of need is crucial:

following flooding and storms in France during 2009, we paid

out 90% of claims in the year. And to reinforce this, 94% of

our customers in France who were hit by Hurricane Klaus were

happy with the way we handled their claims.

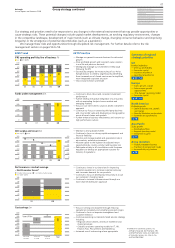

Long-term and savings sales £m

Europe Delta Lloyd

09 18,704

08 17,716

07 17,256

06 14,525

05 12,827

Long-term and savings operating profit £m

Europe Delta Lloyd

09

MCEV*

2,235

IFRS

1,038

08

MCEV*

1,647

IFRS

881

07

MCEV*

1,503

IFRS

777

06

MCEV*

1,171

IFRS

648

05

MCEV*

1,126

IFRS

528

* On a MCEV basis from 2007. Prior years presented on an EEV basis.