Albertsons 2015 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2015 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

NOTE 13—COMPREHENSIVE (LOSS) INCOME AND ACCUMULATED COMPREHENSIVE LOSS

The Company reports comprehensive income in the Consolidated Statements of Comprehensive Income. Comprehensive

income includes all changes in stockholders’ deficit during the reporting period, other than those resulting from investments by

and distributions to stockholders. The Company’s comprehensive income is calculated as net earnings (loss) including

noncontrolling interests, plus or minus adjustments for pension and other postretirement benefit obligations, net of tax, less

comprehensive income attributable to noncontrolling interests.

Accumulated other comprehensive loss represents the cumulative balance of other comprehensive income (loss), net of tax, as

of the end of the reporting period and relates to pension and other postretirement benefit obligation adjustments, net of tax.

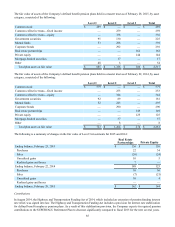

Changes in Accumulated other comprehensive loss by component are as follows:

2015 2014 2013

Pension and postretirement benefit plan accumulated other comprehensive

loss at beginning of the fiscal year, net of tax $(307) $ (612) $ (657)

Other comprehensive (loss) income before reclassifications, net of tax

benefit (expense) of $73, $(85) and $(18), respectively (188) 202 (20)

Pension settlement charge, net of tax expense of $(25), $0 and $0,

respectively 39 — —

Amortization of amounts included in net periodic benefit cost, net of tax

expense of $(21), $(38) and $(40), respectively 33 55 65

Net current-period Other comprehensive income (loss), net of tax benefit

(expense) of $27, $(123) and $(22), respectively (116) 257 45

Divestiture of NAI pension plan accumulated other comprehensive loss,

net of tax (expense) of $0, $(31) and $0 — 48 —

Pension and postretirement benefit plan accumulated other comprehensive

loss at the end of fiscal year, net of tax $(423) $ (307) $ (612)

Upon completion of the sale of NAI in the first quarter of fiscal 2014, the Company disposed of approximately $48 of

Accumulated other comprehensive loss, which was a component of Stockholders’ deficit in the Consolidated Balance Sheet as

of February 23, 2013, due to NAI’s assumption of a defined benefit pension plan established and operated under NAI.

Accumulated other comprehensive loss related to the Company's interest rate swap was insignificant as of February 28, 2015.

Items reclassified out of pension and postretirement benefit plan accumulated other comprehensive loss had the following

impact on the Consolidated Statements of Operations:

2015 2014 2013

Affected Line Item on

Consolidated Statements

of Operations

Pension and postretirement benefit plan

obligations:

Amortization of amounts included in net

periodic benefit expense(1) $ 43 $ 82 $ 93 Selling and administrative

expenses

Amortization of amounts included in net

periodic benefit expense(1) 11 11 12 Cost of sales

Pension settlement charge 64 — — Selling and administrative

expenses

Total reclassifications 118 93 105

Income tax benefit (46) (38)(40)Income tax provision

(benefit)

Total reclassifications, net of tax $ 72 $ 55 $ 65

(1) Amortization of amounts included in net periodic benefit cost include amortization of prior service benefit and

amortization of net actuarial loss as reflected in Note 11—Benefit Plans.

NOTE 14—COMMITMENTS, CONTINGENCIES AND OFF-BALANCE SHEET ARRANGEMENTS

Guarantees