Albertsons 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.49

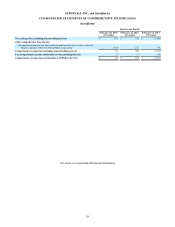

Pension and Other Postretirement Benefit Obligations

Cash contributions to defined benefit pension and other postretirement benefit plans were $169, $124 and $98 in fiscal 2015,

2014 and 2013, respectively, in accordance with the Employee Retirement Income Security Act of 1974, as amended

(“ERISA”), minimum requirements along with certain discretionary contributions made by the Company. Cash contributions

increased in fiscal 2015 primarily due to a $50 discretionary contribution made in fiscal 2015 that helped to offset the decrease

in the funded status of the SUPERVALU Retirement Plan resulting from the plan’s assets and liabilities being re-measured at

November 29, 2014 using a discount rate of 4.1 percent, an expected rate of return on plan assets of 6.5 percent and the

RP-2014 Generational Mortality Table. Cash contributions increased in fiscal 2014 compared to fiscal 2013 due to the

incremental $25 that had been required under the binding term sheet with the PBGC that has now been amended as discussed

elsewhere. The Company anticipates fiscal 2016 contributions to pension and other postretirement benefit plans will be

approximately $55 to $65, which primarily reflects discretionary pension contributions and required minimum other

postretirement benefit plan contributions.

In August 2014, the Highway and Transportation Funding Act of 2014, which included an extension of pension funding interest

rate relief, was signed into law. The Highway and Transportation Funding Act includes a provision for interest rate stabilization

for defined benefit employee pension plans. As a result of this stabilization provision, the Company expects its required

pension contributions to the SUPERVALU INC. Retirement Plan to decrease significantly for the next several years.

The Company’s funding policy for defined benefit pension plans is to contribute the minimum contribution amount required

under ERISA and the Pension Protection Act of 2006 as determined by the Company’s external actuarial consultant. At the

Company’s discretion, additional funds may be contributed to the pension plan. The Company may accelerate contributions or

undertake contributions in excess of the minimum requirements from time to time subject to the availability of cash in excess

of operating and financing needs or other factors as may be applicable. The Company assesses the relative attractiveness of the

use of cash to accelerate contributions considering such factors as expected return on assets, discount rates, cost of debt,

reducing or eliminating required PBGC variable rate premiums or in order to achieve exemption from participant notices of

underfunding.

The Company and AB Acquisition LLC (“AB Acquisition”) entered into a binding term sheet with the PBGC relating to issues

regarding the effect of the sale of NAI on certain SUPERVALU retirement plans. The agreement required that the Company not

pay any dividends to its stockholders at any time for a period of up to five years. The Company had also agreed to make $100

in aggregate contributions to the SUPERVALU Retirement Plan in excess of the minimum required contributions and AB

Acquisition had agreed to provide a guarantee to the PBGC for such excess payments. On September 11, 2014, the Company,

AB Acquisition and the PBGC amended the term sheet. Pursuant to that amendment, the Company made excess contributions

of $47 to the SUPERVALU Retirement Plan and the Company is no longer restricted by the term sheet from paying dividends

to its stockholders and has fully satisfied its obligations to make excess contributions to the SUPERVALU Retirement Plan.

While the Company is no longer restricted from paying dividends to its stockholders under the term sheet, the Company has no

current intent to resume paying dividends. The payment of future dividends is subject to the discretion of the Company’s Board

of Directors and the requirements of Delaware law, and will depend on a variety of factors that the Company’s Board of

Directors may deem relevant. In addition, as described in Note 7—Long-Term Debt in Part II, Item 8 of this Annual Report on

Form 10-K, the Company is limited in the aggregate amount of dividends that the Company may pay during the term of its

Secured Term Loan Facility and would need to meet certain conditions in the Secured Term Loan Facility and the Revolving

ABL Credit Facility before paying a dividend.

During the third quarter of fiscal 2015, the Company made lump sum settlement payments to certain deferred vested pension

plan participants under a lump sum payment option window. The payments were equal to the present value of the participant’s

pension benefits, and were made to certain former employees who were deferred vested participants in the SUPERVALU

Retirement Plan, who had not yet begun receiving monthly pension benefit payments and who elected to participate in the lump

sum payment option window. In fiscal 2015, the SUPERVALU Retirement Plan made lump sum settlement payments of

approximately $272. The lump sum settlement payments resulted in a non-cash pension settlement charge of $64 from the

acceleration of a portion of the accumulated unrecognized actuarial loss.