Albertsons 2015 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2015 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

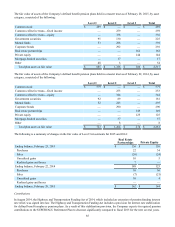

Amounts recognized in the Consolidated Balance Sheets consist of the following:

Pension Benefits

Other Postretirement

Benefits

2015 2014 2015 2014

Accrued vacation, compensation and benefits $ (2) $ (3) $ (6) $ (6)

Pension and other postretirement benefit obligations (530)(462)(72)(75)

Total $ (532) $ (465) $ (78) $ (81)

Amounts recognized in Accumulated other comprehensive loss for the defined benefit pension and other postretirement benefit

plans consist of the following:

Pension Benefits

Other Postretirement

Benefits

2015 2014 2015 2014

Prior service benefit $ — $ — $ 45 $ 55

Net actuarial loss (696)(567)(28)(25)

Total recognized in Accumulated other comprehensive

loss $(696) $ (567) $ 17 $ 30

Total recognized in Accumulated other comprehensive

loss, net of tax $(432) $ (324) $ 9 $ 17

Net periodic benefit cost (income) and other changes in plan assets and benefit obligations recognized in Other comprehensive

(loss) income for defined benefit pension and other postretirement benefit plans consist of the following:

Pension Benefits Other Postretirement Benefits

2015 2014 2013 2015 2014 2013

Net Periodic Benefit Cost

Service cost $ — $ — $ — $ 1 $ 2 $ 2

Interest cost 121 121 123 4 4 5

Expected return on plan assets (149) (141)(133) — — —

Amortization of prior service benefit — — — (16)(13)(12)

Amortization of net actuarial loss 68 101 111 3 5 6

Settlement 64 — — — — —

Net periodic benefit cost (income) 104 81 101 (8)(2) 1

Other Changes in Plan Assets and Benefit

Obligations Recognized in Other

Comprehensive (Loss) Income

Prior service benefit — — — (5)(11) —

Amortization of prior service benefit — — — 16 12 13

Net actuarial loss (gain) 195 (259) 46 6 (16)(7)

Amortization of net actuarial loss (66) (101)(110)(3)(5)(6)

Total expense (benefit) recognized in Other

comprehensive (loss) income 129 (360)(64) 14 (20) —

Total expense (benefit) recognized in net

periodic benefit cost (income) and Other

comprehensive (loss) income $ 233 $ (279) $ 37 $ 6 $ (22) $ 1

The estimated net actuarial loss that will be amortized from Accumulated other comprehensive loss into net periodic benefit

cost for the defined benefit pension plans during fiscal 2016 is $79. The estimated net amount of prior service benefit and net

actuarial loss for the postretirement benefit plans that will be amortized from Accumulated other comprehensive loss into net

periodic benefit cost during fiscal 2016 is $10.

During fiscal 2015, the Company converted to the RP-2014 Aggregate mortality table for calculating the pension and other

postretirement obligations and the annual expense. This change increased the projected benefit obligation by $182 and the

accumulated postretirement benefit obligation by $6. This conversion is expected to increase the fiscal 2016 defined benefit

pension plans expense by $32.