Albertsons 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

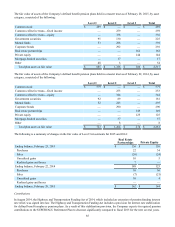

Deferred Income Taxes

Deferred income taxes reflect the net tax effects of temporary differences between the bases of assets and liabilities for

financial reporting and income tax purposes. The Company’s deferred tax assets and liabilities consisted of the following:

2015 2014

Deferred tax assets:

Compensation and benefits $ 234 $ 224

Self-insurance 25 24

Property, plant and equipment and capitalized lease assets 72 132

Loss on sale of discontinued operations 1,387 1,339

Net operating loss carryforwards 19 23

Other 69 80

Gross deferred tax assets 1,806 1,822

Valuation allowance (1,404)(1,356)

Total deferred tax assets 402 466

Deferred tax liabilities:

Property, plant and equipment and capitalized lease assets (88)(147)

Inventories (14)(40)

Intangible assets (27)(25)

Other (23)(16)

Total deferred tax liabilities (152)(228)

Net deferred tax asset $ 250 $ 238

Net deferred tax assets are recorded in the Consolidated Balance Sheets as follows:

2015 2014

Deferred tax assets $ 265 $ 287

Other current liabilities (15)(49)

Net deferred tax asset $ 250 $ 238

The Company has valuation allowances to reduce deferred tax assets to the amount that is more-likely-than-not to be realized.

The Company currently has state net operating loss (“NOL”) carryforwards of $414 for tax purposes. The NOL carryforwards

expire beginning in 2016 and continuing through 2034 and have a $16 valuation allowance. The sale of NAI resulted in an

allocation of tax expense between continuing and discontinued operations. Included in discontinued operations is the

recognition of the additional tax basis in the shares of NAI offset by a valuation allowance on the capital loss that resulted from

the sale of shares. The Company has recorded a valuation allowance against the projected capital loss because there is no clear

evidence that the capital loss will be used prior to its expiration in fiscal 2019.

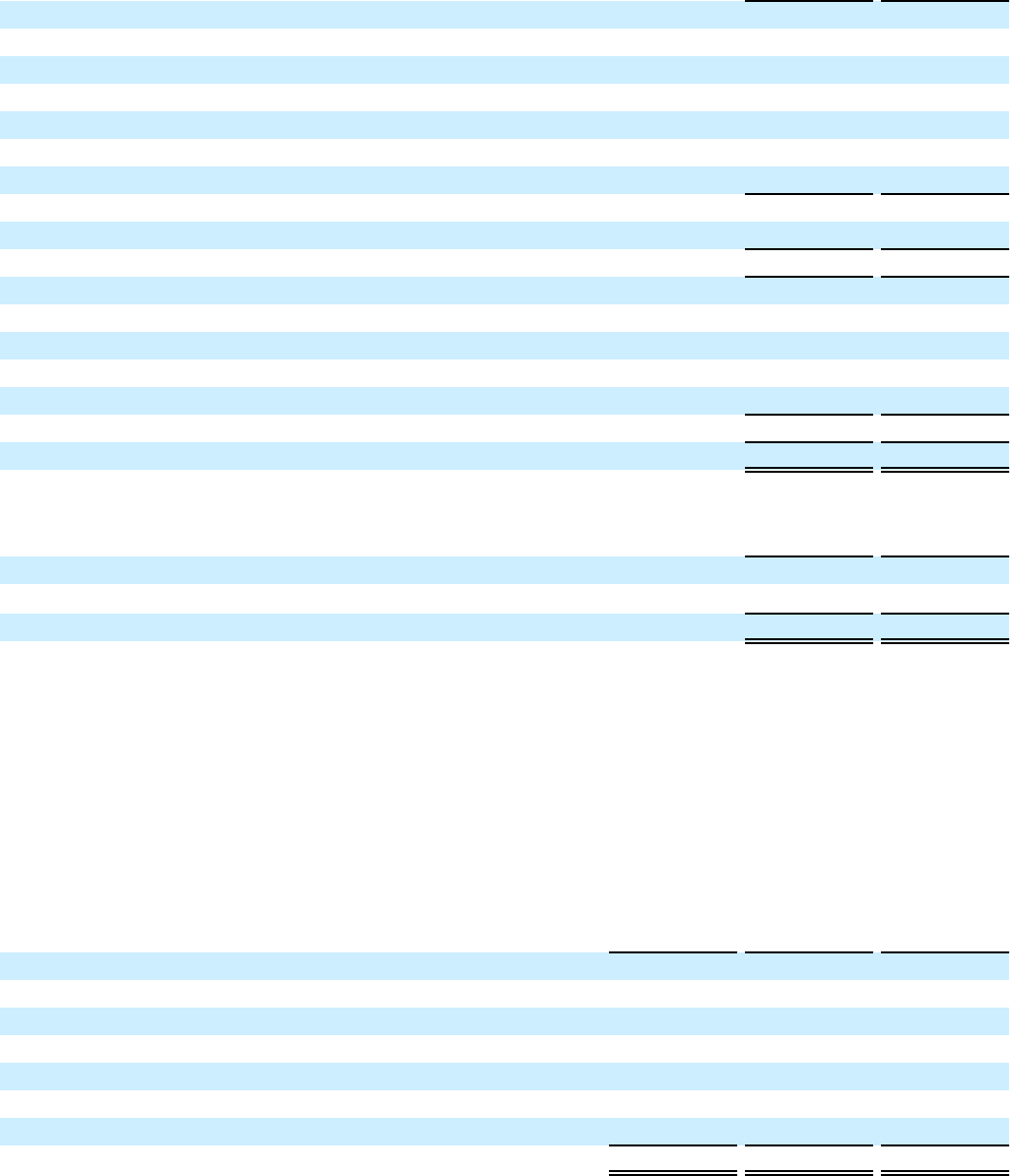

Uncertain Tax Positions

Changes in the Company’s unrecognized tax benefits consisted of the following:

2015 2014 2013

Beginning balance $ 76 $ 187 $ 165

Increase based on tax positions related to the current year 15 15 5

Decrease based on tax positions related to the current year — — (1)

Increase based on tax positions related to prior years 15 8 82

Decrease based on tax positions related to prior years (4)(2)(58)

Decrease related to settlements with taxing authorities (3)(128)(3)

Decrease due to lapse of statute of limitations (5)(4)(3)

Ending balance $ 94 $ 76 $ 187

Included in the balance of unrecognized tax benefits as of February 28, 2015, February 22, 2014 and February 23, 2013 are tax

positions of $36 net of tax, $48 net of tax, and $60 net of tax, respectively, which would reduce the Company’s effective tax

rate if recognized in future periods.