Albertsons 2015 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2015 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

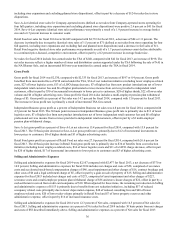

Fiscal Years Ended

February 28, 2015

(53 weeks)

February 22, 2014

(52 weeks)

February 23, 2013

(52 weeks)

Net sales $ 17,820 100.0% $ 17,153 100.0% $ 17,136 100.0 %

Cost of sales 15,242 85.5 14,623 85.3 14,803 86.4

Gross profit 2,578 14.5 2,530 14.7 2,333 13.6

Selling and administrative expenses 2,154 12.1 2,107 12.3 2,477 14.5

Goodwill and intangible asset impairment charge — — — — 6 —

Operating earnings (loss) 424 2.4 423 2.5 (150) (0.9)

Interest expense, net 243 1.4 407 2.4 269 1.6

Equity in earnings of unconsolidated affiliates (4) — (2) — (3) —

Earnings (loss) from continuing operations before income taxes 185 1.0 18 0.1 (416) (2.4)

Income tax provision (benefit) 58 0.3 5 — (163) (1.0)

Net earnings (loss) from continuing operations 127 0.7 13 0.1 (253) (1.5)

Income (loss) from discontinued operations, net of tax 72 0.4 176 1.0 (1,203) (7.0)

Net earnings (loss) including noncontrolling interests 199 1.1 189 1.1 (1,456) (8.5)

Less net earnings attributable to noncontrolling interests (7) — (7) — (10) 0.1

Net earnings (loss) attributable to SUPERVALU INC. $ 192 1.1% $ 182 1.1% $ (1,466) (8.6)%

Basic net earnings (loss) per share attributable to SUPERVALU INC.:

Continuing operations $ 0.46 $ 0.02 $ (1.24)

Discontinued operations $ 0.28 $ 0.69 $ (5.67)

Basic net earnings per share $ 0.74 $ 0.71 $ (6.91)

Diluted net earnings (loss) per share attributable to SUPERVALU INC.:

Continuing operations $ 0.45 $ 0.02 $ (1.24)

Discontinued operations $ 0.27 $ 0.68 $ (5.67)

Diluted net earnings per share $ 0.73 $ 0.70 $ (6.91)

Comparison of fiscal 2015 ended February 28, 2015 and fiscal 2014 ended February 22, 2014:

Net Sales

Net sales for fiscal 2015 were $17,820, compared with $17,153 last year, an increase of $667 or 3.9 percent. The 53rd week added

approximately $313 to Net sales in fiscal 2015. Independent Business net sales were 45.6 percent of Net sales, Save-A-Lot net

sales were 25.9 percent of Net sales, Retail Food net sales were 27.4 percent of Net sales and Corporate TSA fees were 1.1

percent of Net sales for fiscal 2015, compared with 46.9 percent, 24.6 percent, 27.1 percent and 1.4 percent, respectively, for last

year.

Independent Business net sales for fiscal 2015 were $8,134, compared with $8,036 last year, an increase of $98 or 1.2 percent.

The increase is primarily due to $143 from an additional week of sales in fiscal 2015, and $375 from new accounts, existing

customers and new affiliations, offset in part by $421 from lost accounts, including one NAI banner that completed the transition

to self-distribution part way through the year and the loss of one of the Company's larger customers.

Save-A-Lot net sales for fiscal 2015 were $4,613, compared with $4,228 last year, an increase of $385 or 9.1 percent. The

increase is primarily due to positive network identical store sales of 5.8 percent or $226 (defined as net sales from Company-

operated stores and sales to licensee stores operating for four full quarters, including store expansions and excluding planned store

dispositions), $147 of sales due to new store openings and other revenue and $79 from an additional week of sales in fiscal 2015,

offset in part by a decrease of $67 due to store dispositions by licensees.

Save-A-Lot identical store sales for Company-operated stores (defined as net sales from Company-operated stores operating for

four full quarters, including store expansions and excluding planned store dispositions) were positive 7.6 percent or $127 for

fiscal 2015. Save-A-Lot corporate identical store sales performance was primarily a result of a 5.4 percent increase in customer

count and a 2.1 percent increase in average basket size.

Retail Food net sales for fiscal 2015 were $4,879, compared with $4,649 last year, an increase of $230 or 4.9 percent. The

increase in Retail Food net sales was driven by several factors, including a $101 increase in sales due to newly acquired stores, an