Albertsons 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

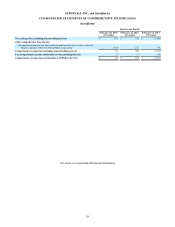

Interest Rate Positions as of February 28, 2015

February 28,

2015 Aggregate Payments by Fiscal Year

Fair

Value Total 2016 2017 2018 2019 2020 Thereafter

(in millions, except rates)

Debt with variable interest rates

Principal payments $ 1,171 $ 1,169 $ 10 $ 15 $ 15 $ 15 $ 1,114 $ —

Variable interest rate 4.5% 4.5% 4.5% 4.5% 4.5% 4.5% —%

Debt with fixed interest rates

Principal payments on senior notes $ 1,076 $ 1,028 $ — $ 278 $ — $ — $ — $ 750

Average fixed rate 7.4% —% 8.0% —% —% —% 7.2%

Principal payments on floating rate

debt converted to fixed rate debt(1) $ 301 $ 300 $ — $ — $ — $ — $ 300 $ —

Fixed interest rate 5.5% —% —% —% —% 5.5% —%

Notes receivable

Principal receivable $ 31 $ 29 $ 11 $ 5 $ 4 $ 3 $ 2 $ 4

Average rate receivable 7.2% 7.4% 7.7% 7.8% 8.0% 6.5% 4.7%

Interest rate swap related to debt

with variable interest rates:

Pay fixed-receive variable financial

instrument amount(1) $ — $ — $ — $ — $ — $ — $ — $ —

Forward starting fixed rate paid 2.0% —% —% —% —% 2.0% —%

Forward starting variable rate

received Rate A(2) —% —% —% —% Rate A(2) —%

(1) Pay fixed-receive variable interest rate swap relates to the $300 of debt with variable interest payments under the Secured Term Loan

Facility. Fixed rate payments begin in February 2016 and conclude in March 2019. The fair value of this instrument represents a liability

of $0 as of February 28, 2015.

(2) Rate A - One-month LIBOR, subject to a 1.00 percent floor.

Investment Risk

The SUPERVALU Retirement Plan, which is a Company-sponsored qualified pension plan, holds investments in public and

private equity, fixed income and real estate securities, which is described further in Note 11—Benefit Plans in Item 8 of this

Annual Report on Form 10-K. Changes in SUPERVALU Retirement Plan assets can affect the amount of our anticipated future

contributions. In addition, increases or decreases in SUPERVALU Retirement Plan assets and can result in a related increase or

decrease to the Company's equity through Accumulated other comprehensive loss. As of February 28, 2015, a 10 percent

unfavorable change in the value of investments held by the SUPERVALU Retirement Plan would not have an impact on our

Company's minimum contributions required under ERISA for fiscal 2016, but would result in an unfavorable change in net

periodic pension expense for fiscal 2016 by $17 and would reduce stockholder's equity by $232 on a pre-tax basis as of

February 28, 2015.

Fuel Price Risk

The Company is exposed to potential volatility in fuel prices due to the Company's use of diesel fuel in distribution. The

Company's supply arrangements in the majority of the circumstances provides for sharing fluctuations in fuel market prices

with its independent retail customers and Save-A-Lot licensees. The Company’s limited involvement with diesel fuel

derivatives is primarily to manage its exposure to changes in energy prices utilized in the shipping process and are only utilized

to manage well-defined risks. The fair value of the Company’s fuel derivatives represent a liability of $1 as of February 28,

2015.