Albertsons 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

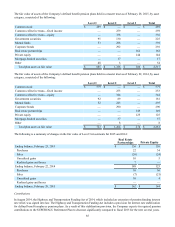

The fair value of assets of the Company’s defined benefit pension plans held in a master trust as of February 28, 2015, by asset

category, consisted of the following:

Level 1 Level 2 Level 3 Total

Common stock $ 489 $ — $ — $ 489

Common collective trusts—fixed income — 259 — 259

Common collective trusts—equity — 336 — 336

Government securities 95 130 — 225

Mutual funds 53 286 — 339

Corporate bonds — 292 — 292

Real estate partnerships — — 162 162

Private equity — — 144 144

Mortgage-backed securities — 17 — 17

Other 48 6 — 54

Total plan assets at fair value $ 685 $ 1,326 $ 306 $ 2,317

The fair value of assets of the Company’s defined benefit pension plans held in a master trust as of February 22, 2014, by asset

category, consisted of the following:

Level 1 Level 2 Level 3 Total

Common stock $ 579 $ — $ — $ 579

Common collective trusts—fixed income — 253 — 253

Common collective trusts—equity — 344 — 344

Government securities 92 89 — 181

Mutual funds 52 243 — 295

Corporate bonds — 290 — 290

Real estate partnerships — — 149 149

Private equity — — 125 125

Mortgage-backed securities — 37 — 37

Other — 8 — 8

Total plan assets at fair value $ 723 $ 1,264 $ 274 $ 2,261

The following is a summary of changes in the fair value of Level 3 investments for 2015 and 2014:

Real Estate

Partnerships Private Equity

Ending balance, February 23, 2013 $ 136 $ 110

Purchases 22 34

Sales (26)(24)

Unrealized gains 10 5

Realized gains and losses 7 —

Ending balance, February 22, 2014 149 125

Purchases 10 36

Sales (7)(21)

Unrealized gains 10 4

Realized gains and losses — —

Ending balance, February 28, 2015 $ 162 $ 144

Contributions

In August 2014, the Highway and Transportation Funding Act of 2014, which included an extension of pension funding interest

rate relief, was signed into law. The Highway and Transportation Funding Act includes a provision for interest rate stabilization

for defined benefit employee pension plans. As a result of this stabilization provision, the Company expects its required pension

contributions to the SUPERVALU Retirement Plan to decrease significantly compared to fiscal 2015 for the next several years.