Albertsons 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

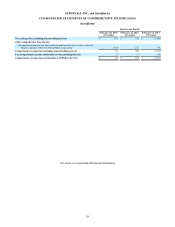

SUPERVALU INC. and Subsidiaries

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions)

Fiscal Years Ended

February 28,

2015

(53 weeks)

February 22,

2014

(52 weeks)

February 23,

2013

(52 weeks)

Cash flows from operating activities

Net earnings (loss) including noncontrolling interests $ 199 $ 189 $ (1,456)

Income (loss) from discontinued operations, net of tax 72 176 (1,203)

Net earnings (loss) from continuing operations 127 13 (253)

Adjustments to reconcile Net earnings (loss) from continuing operations to Net cash

provided by operating activities—continuing operations:

Goodwill and intangible asset impairment charges — — 6

Asset impairment and other charges 45 194 283

Net gain on sale of assets and exits of surplus leases (14) (17) (6)

Depreciation and amortization 285 302 365

LIFO charge (credit) 8 (9) 4

Deferred income taxes 4 (39) (50)

Stock-based compensation 23 22 13

Net pension and other postretirement benefits cost 96 79 102

Contributions to pension and other postretirement benefit plans (169) (124) (98)

Other adjustments 30 34 26

Changes in operating assets and liabilities, net of effects from business combinations:

Receivables 9 (54) 30

Inventories (124) 2 51

Accounts payable and accrued liabilities 75 (127) (69)

Income taxes (15) (79) 75

Other changes in operating assets and liabilities (47) (68) (52)

Net cash provided by operating activities—continuing operations 333 129 427

Net cash provided by (used in) operating activities—discontinued operations 75 (101) 481

Net cash provided by operating activities 408 28 908

Cash flows from investing activities

Proceeds from sale of assets 7 14 38

Purchases of property, plant and equipment (239) (111) (228)

Payments for business acquisition (55) — —

Other 2 11 1

Net cash used in investing activities—continuing operations (285) (86) (189)

Net cash provided by (used in) investing activities—discontinued operations — 135 (175)

Net cash (used in) provided by investing activities (285) 49 (364)

Cash flows from financing activities

Proceeds from issuance of debt 350 2,098 1,713

Proceeds from the sale of common stock 7 177 —

Payments of debt and capital lease obligations (400) (2,221) (2,099)

Payments for debt financing costs (42) (151) (66)

Distributions to noncontrolling interests (8) (9) (10)

Dividends paid — — (37)

Other 1 (1) (7)

Net cash used in financing activities—continuing operations (92) (107) (506)

Net cash used in financing activities—discontinued operations — (36) (46)

Net cash used in financing activities (92) (143) (552)

Net increase (decrease) in cash and cash equivalents 31 (66) (8)

Cash and cash equivalents at beginning of year 83 149 157

Cash and cash equivalents at end of year $ 114 $ 83 $ 149

Less cash and cash equivalents of discontinued operations at end of year — — (77)

Cash and cash equivalents of continuing operations at end of year $ 114 $ 83 $ 72

SUPPLEMENTAL CASH FLOW INFORMATION

The Company’s non-cash activities were as follows:

Capital lease asset additions $ 1 $ 2 $ 13

Purchases of property, plant and equipment included in Accounts payable $ 21 $ 19 $ 10

Interest and income taxes paid:

Interest paid, net of amounts capitalized $ 180 $ 227 $ 232

Income taxes (refunded) paid, net $ (7) $ 118 $ 31

See Notes to Consolidated Financial Statements.