Albertsons 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

(4) Amounts include contractual interest payments using the interest rate as of February 28, 2015 applicable to the Company’s

variable interest debt instruments and stated fixed rates for all other debt instruments.

(5) Represents the minimum rents payable under operating leases, excluding common area maintenance, insurance or tax

payments, for which the Company is also obligated, offset by minimum subtenant rentals of $56, $16, $28, $11 and $1,

respectively.

(6) Represents the minimum payments under capital leases, excluding common area maintenance, insurance or tax payments,

for which the Company is also obligated, offset by minimum subtenant rentals of $25, $6, $9, $5 and $5, respectively.

(7) The Company’s purchase obligations include various obligations that have annual purchase commitments of $1 or greater.

As of February 28, 2015, future purchase obligations existed that primarily related to fixed asset and information

technology commitments. In addition, in the ordinary course of business, the Company enters into supply contracts to

purchase product for resale to consumers and to Independent Business wholesale customers, which are typically of a short-

term nature with limited or no purchase commitments. The majority of our supply contracts are short-term in nature and

relate to fixed assets, information technology and contracts to purchase product for resale. These supply contracts typically

include either volume commitments or fixed expiration dates, termination provisions and other standard contractual

considerations. The supply contracts that are cancelable have not been included above.

(8) The Company’s insurance reserves include the undiscounted obligations related to workers’ compensation, general and

automobile liabilities at the estimated ultimate cost of reported claims and claims incurred but not yet reported and related

expenses.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The Company does not use financial instruments or derivatives for any trading or other speculative purposes.

Interest Rate Risk

The Company is exposed to market pricing risk consisting of interest rate risk related to debt obligations and notes receivable

outstanding. Interest rate risk is managed through the strategic use of fixed and variable rate debt and, to a limited extent,

derivative financial instruments. Variable interest rate debt (bank loans and revolving lines of credit) is utilized to help maintain

liquidity and finance business operations. Variable rate borrowings consist primarily of LIBOR and prime rate based loans,

some of which contain interest rate floors. Long-term debt with fixed interest rates is used to assist in managing debt maturities

and to diversify sources of debt capital. Changes in interest rates related to debt with fixed interest rates do not have an impact

upon future results of operations and cash flow while outstanding; however, if additional debt issuances are required to fund

fixed rate debt maturities, future results of operations or cash flows may be impacted.

Long-term loans are extended to certain independent retail customers in the normal course of business through notes

receivable. The notes generally bear fixed interest rates negotiated with each independent retail customer. The market value of

the fixed rate notes is subject to change due to fluctuations in market interest rates.

On February 24, 2015, the Company entered into a forward starting interest rate swap agreement effectively converting $300 of

variable rate debt under the Company's Secured Term Loan Facility (defined below) to a fixed rate of 5.5075 percent, effective

beginning in February 2016 through the Secured Term Loan Facility's maturity in March 2019. This transaction was entered

into to reduce the Company's exposure to changes in market interest rates associated with its variable rate debt. Changes in

market interest rates affecting the fair value of the financial instrument and unfavorable changes in interest expense, and

counterparty credit risk are some of the risks associated with utilizing interest rate swaps. As of February 28, 2015, a 100 basis

point increase or decrease in forward LIBOR interest rates would increase or decrease, respectively, the fair value of the

interest rate swap by approximately $7.

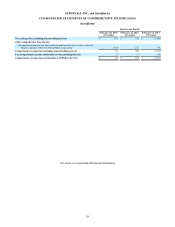

The table below provides information about the Company’s financial instruments that are sensitive to changes in interest rates,

including debt obligations, notes receivable and interest rate swaps. For debt obligations, the table presents principal payments

and related weighted average interest rates by year of maturity using interest rates as of February 28, 2015, applicable to

variable interest debt instruments and stated fixed rates for all other debt instruments, excluding any original issue discounts.

For notes receivable, the table presents the expected collection of principal cash flows and weighted average interest rates by

expected year of maturity. For the interest rate swap agreement, the table presents the differential between interest payable and

interest receivable under the swap agreement utilized to compute the fair value of the interest rate swaps.