Albertsons 2015 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2015 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

store-level impairment review within these previous geographic market asset groups, which resulted in a non-cash impairment

charge of approximately $8 in fiscal 2013.

Due to the ongoing business transformation and highly competitive environment, the Company will continue to evaluate its

long-lived asset policy and current asset groups to determine if additional modifications to the policy are necessary. Future

changes to the Company’s assessment of its long-lived asset policy and changes in circumstances, operating results or other

events may result in additional asset impairment testing and charges.

During fiscal 2013, the Company announced the closure of approximately 22 non-strategic stores within the Save-A-Lot

segment, including the exit of a geographic market, resulting in an impairment of $16 related to these stores’ long-lived assets.

See Note 4—Reserves for Closed Properties and Property, Plant and Equipment-related Impairment Charges for additional

information.

Reserves for Closed Properties

The Company maintains reserves for costs associated with closures of retail stores, distribution centers and other properties that

are no longer being utilized in current operations. The Company provides for closed property operating lease liabilities using a

discount rate to calculate the present value of the remaining noncancellable lease payments after the closing date, reduced by

estimated subtenant rentals that could be reasonably obtained for the property. Lease reserve impairment charges are recorded

as a component of Selling and administrative expenses in the Consolidated Statements of Operations.

The closed property lease liabilities usually are paid over the remaining lease terms, which generally range from one to 15

years. Adjustments to closed property reserves primarily relate to changes in subtenant income or actual exit costs differing

from original estimates. Adjustments are made for changes in estimates in the period in which the changes become known.

The calculation of the closed property charges requires significant judgments and estimates, including estimated subtenant

rentals, discount rates and future cash flows based on the Company’s experience and knowledge of the market in which the

closed property is located, previous efforts to dispose of similar assets and the assessment of existing market conditions.

Reserves for closed properties are included in Other current liabilities and Other long-term liabilities in the Consolidated

Balance Sheets.

Deferred Rent

The Company recognizes rent holidays, including the time period during which the Company has access to the property prior to

the opening of the site, as well as construction allowances and escalating rent provisions, on a straight-line basis over the term

of the operating lease. The deferred rents are included in Other current liabilities and Other long-term liabilities in the

Consolidated Balance Sheets.

Self-Insurance Liabilities

The Company uses a combination of insurance and self-insurance for workers’ compensation, automobile and general liability

costs. It is the Company’s policy to record its insurance liabilities based on management’s estimate of the ultimate cost of

reported claims and claims incurred but not yet reported and related expenses, discounted at a risk-free interest rate. The

present value of such claims was calculated using discount rates ranging from 0.3 percent to 5.1 percent for fiscal 2015, 0.3

percent to 5.1 percent for fiscal 2014 and 0.4 percent to 5.1 percent for fiscal 2013.

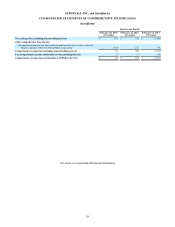

Changes in the Company’s insurance liabilities consisted of the following:

2015 2014 2013

Beginning balance $ 103 $ 97 $ 93

Expense 31 34 29

Claim payments (32)(33)(27)

Reclassification of insurance recoveries to receivables (9) 5 2

Ending balance 93 103 97

Less current portion (30)(33)(27)

Long-term portion $ 63 $ 70 $ 70

The current portion of reserves for self-insurance is included in Other current liabilities and the long-term portion is included in

Other long-term liabilities in the Consolidated Balance Sheets. The insurance liabilities as of the end of the fiscal year are net of

discounts of $6 and $7 as of February 28, 2015 and February 22, 2014, respectively. The related insurance receivables were $9