3M 2013 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2013 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

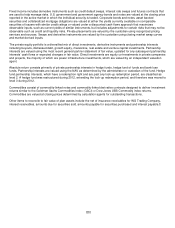

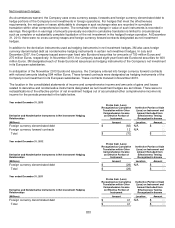

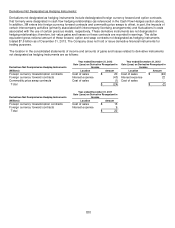

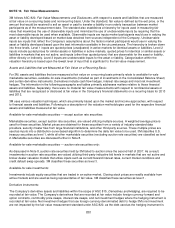

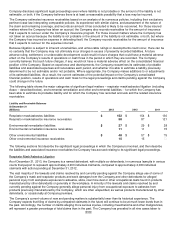

Derivatives Not Designated as Hedging Instruments:

Derivatives not designated as hedging instruments include dedesignated foreign currency forward and option contracts

that formerly were designated in cash flow hedging relationships (as referenced in the Cash Flow Hedges section above).

In addition, 3M enters into foreign currency forward contracts and commodity price swaps to offset, in part, the impacts of

certain intercompany activities (primarily associated with intercompany licensing arrangements) and fluctuations in costs

associated with the use of certain precious metals, respectively. These derivative instruments are not designated in

hedging relationships; therefore, fair value gains and losses on these contracts are recorded in earnings. The dollar

equivalent gross notional amount of these forward, option and swap contracts not designated as hedging instruments

totaled $7.5 billion as of December 31, 2013. The Company does not hold or issue derivative financial instruments for

trading purposes.

The location in the consolidated statements of income and amounts of gains and losses related to derivative instruments

not designated as hedging instruments are as follows:

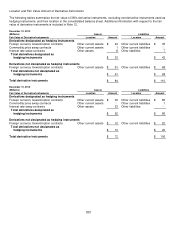

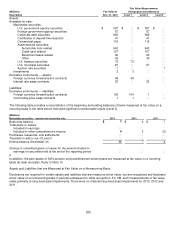

Derivatives Not Designated as Hedging Instruments

Year ended December 31, 2013

Year ended December 31, 2012

Gain (Loss) on Derivative Recognized in

Income

Gain (Loss) on Derivative Recognized in

Income

(Millions)

Location

Amount

Location

Amount

Foreign currency forward/option contracts

Cost of sales $

20 Cost of sales $

(24)

Foreign currency forward contracts

Interest expense (43) Interest expense 22

Commodity price swap contracts

Cost of sales (1) Cost of sales ―

Total

$

(24) $

(2)

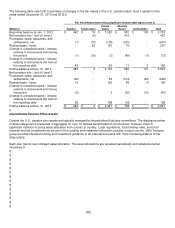

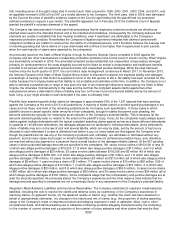

Derivatives Not Designated as Hedging Instruments

Year ended December 31, 2011

Gain (Loss) on Derivative Recognized in

Income

(Millions)

Location

Amount

Foreign currency forward/option contracts

Cost of sales $

13

Foreign currency forward contracts

Interest expense 9

Total

$

22