3M 2013 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2013 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

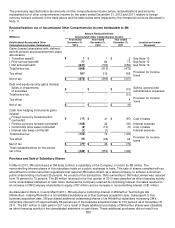

The previously reported before-tax amounts of other comprehensive income before reclassifications and amounts

reclassified out of other comprehensive income for the years ended December 31, 2012 and 2011 relative to foreign

currency forward contracts in the table above and the table below were impacted by the immaterial revisions discussed in

Note 11.

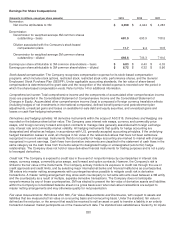

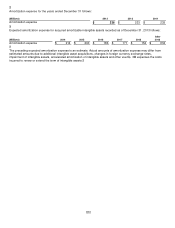

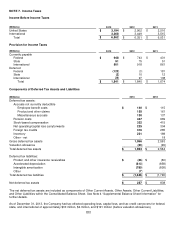

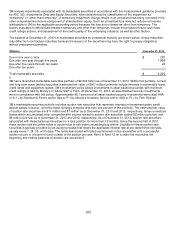

Reclassifications out of Accumulated Other Comprehensive Income Attributable to 3M

Amount Reclassified from

(Millions) Accumulated Other Comprehensive Income

Location on Income

Statement

Details about Accumulated Other

Comprehensive Income Components

Year ended

December 31,

2013

Year ended

December 31,

2012

Year ended

December 31,

2011

Gains (losses) associated with, defined

benefit pension and postretirement plans

amortization

Transition asset

$

1

$

1

$

2

See Note 10

Prior service benefit

77

84

75

See Note 10

Net actuarial loss

(647)

(700)

(552)

See Note 10

Total before tax

(569)

(615)

(475)

Tax effect

197

219

168

Provision for income

taxes

Net of tax

$

(372)

$

(396)

$

(307)

Debt and equity security gains (losses)

Sales or impairments

of securities

$

―

$

―

$

(10)

Selling, general and

administrative expenses

Total before tax

―

―

(10)

Tax effect

―

―

4

Provision for income

taxes

Net of tax

$

―

$

―

$

(6)

Cash flow hedging instruments gains

(losses)

Foreign currency forward/option

contracts

$

(11)

$

41

$

(87)

Cost of sales

Foreign currency forward contracts

(108)

42

(30)

Interest expense

Commodity price swap contracts

(2)

(10)

(6)

Cost of sales

Interest rate swap contracts

(1)

(1)

―

Interest expense

Total before tax

(122)

72

(123)

Tax effect

45

(26)

44

Provision for income

taxes

Net of tax

$

(77)

$

46

$

(79)

Total reclassifications for the period,

net of tax

$

(449)

$

(350)

$

(392)

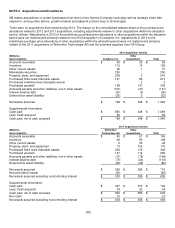

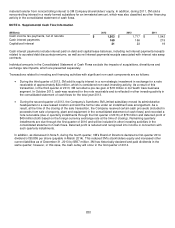

Purchase and Sale of Subsidiary Shares

In March 2013, 3M sold shares in 3M India Limited, a subsidiary of the Company, in return for $8 million. The

noncontrolling interest shares of this subsidiary trade on a public exchange in India. This sale of shares complied with an

amendment to Indian securities regulations that required 3M India Limited, as a listed company, to achieve a minimum

public shareholding of at least 25 percent. As a result of this transaction, 3M’s ownership in 3M India Limited was reduced

from 76 percent to 75 percent. The $8 million received in the first quarter of 2013 was classified as other financing activity

in the consolidated statement of cash flows. Because the Company retained its controlling interest, the sales resulted in

an increase of 3M Company shareholder’s equity of $7 million and an increase in noncontrolling interest of $1 million.

As discussed in Note 2, in early March 2011, 3M acquired a controlling interest in Winterthur Technologie AG

(Winterthur), making Winterthur a consolidated subsidiary as of that business acquisition date. Subsequent to this

business acquisition date, 3M purchased additional outstanding shares of its Winterthur subsidiary increasing 3M’s

ownership interest from approximately 86 percent as of the business acquisition date to 100 percent as of December 31,

2011. The $57 million of cash paid in 2011 as a result of these additional purchases of Winterthur shares was classified

as other financing activity in the consolidated statement of cash flows. These additional purchases did not result in a