3M 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.57

used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs

by requiring that the most observable inputs be used when available. Observable inputs are inputs market participants

would use in valuing the asset or liability developed based on market data obtained from sources independent of the

Company. Unobservable inputs are inputs that reflect the Company’s assumptions about the factors market participants

would use in valuing the asset or liability developed based upon the best information available in the circumstances. The

hierarchy is broken down into three levels. Level 1 inputs are quoted prices (unadjusted) in active markets for identical

assets or liabilities. Level 2 inputs include quoted prices for similar assets or liabilities in active markets, quoted prices for

identical or similar assets or liabilities in markets that are not active, and inputs (other than quoted prices) that are

observable for the asset or liability, either directly or indirectly. Level 3 inputs are unobservable inputs for the asset or

liability. Categorization within the valuation hierarchy is based upon the lowest level of input that is significant to the fair

value measurement.

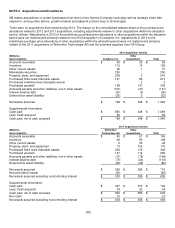

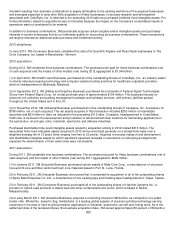

Acquisitions: The Company accounts for business acquisitions in accordance with ASC 805, Business Combinations. This

standard requires the acquiring entity in a business combination to recognize all (and only) the assets acquired and

liabilities assumed in the transaction and establishes the acquisition-date fair value as the measurement objective for all

assets acquired and liabilities assumed in a business combination. Certain provisions of this standard prescribe, among

other things, the determination of acquisition-date fair value of consideration paid in a business combination (including

contingent consideration) and the exclusion of transaction and acquisition-related restructuring costs from acquisition

accounting.

New Accounting Pronouncements

In May 2011, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2011-

04, Fair Value Measurement: Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements

in U.S. GAAP and IFRSs. This standard clarifies guidance on how to measure fair value and is largely consistent with

existing fair value measurement principles. The ASU also expands existing disclosure requirements for fair value

measurements and makes other amendments. For 3M, this ASU was effective prospectively beginning January 1, 2012.

The adoption of this standard did not have a material impact on 3M’s consolidated results of operations or financial

condition.

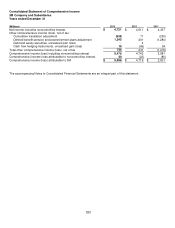

In June 2011, the FASB issued ASU No. 2011-05, Presentation of Comprehensive Income, and in December 2011 issued

ASU No. 2011-12, Deferral of the Effective Date for Amendments to the Presentation of Reclassification of Items Out of

Accumulated Other Comprehensive Income in Accounting Standards Update No. 2011-05. These standards require

entities to present items of net income and other comprehensive income either in a single continuous statement, or in

separate, but consecutive, statements of net income and other comprehensive income. The new requirements do not

change which components of comprehensive income are recognized in net income or other comprehensive income, or

when an item of other comprehensive income must be reclassified to net income. Also, the earnings-per share

computation does not change. However, the option under previous standards to report other comprehensive income and

its components in the statement of changes in equity was eliminated. For 3M, these standards were effective

retrospectively beginning January 1, 2012, with early adoption permitted. 3M adopted these standards in the fourth

quarter of 2011. Since these standards impact presentation and disclosure requirements only, their adoption did not have

a material impact on 3M’s consolidated results of operations or financial condition.

In September 2011, the FASB issued ASU No. 2011-08, Testing Goodwill for Impairment. Under this standard, entities

testing goodwill for impairment now have an option of performing a qualitative assessment before having to calculate the

fair value of a reporting unit. If an entity determines, on the basis of qualitative factors, that the fair value of the reporting

unit is more-likely-than-not less than the carrying amount, the existing quantitative impairment test is required. Otherwise,

no further impairment testing is required. For 3M, this ASU was effective beginning January 1, 2012, with early adoption

permitted under certain conditions. The adoption of this standard did not have a material impact on 3M’s consolidated

results of operations or financial condition.

In December 2011, the FASB issued ASU No. 2011-11, Disclosures About Offsetting Assets and Liabilities, and in

January 2013 issued ASU No. 2013-01, Clarifying the Scope of Disclosures About Offsetting Assets and Liabilities. These

standards created new disclosure requirements regarding the nature of an entity’s rights of setoff and related

arrangements associated with its derivative instruments, repurchase agreements, and securities lending transactions.

Certain disclosures of the amounts of certain instruments subject to enforceable master netting arrangements are

required, irrespective of whether the entity has elected to offset those instruments in the statement of financial position.

For 3M, these ASUs were effective January 1, 2013 with retrospective application required. The additional disclosures

required by these ASUs are included in Note 11. Since these standards impact disclosure requirements only, their

adoption did not have a material impact on 3M’s consolidated results of operations or financial condition.