3M 2013 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2013 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

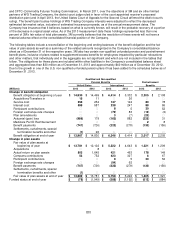

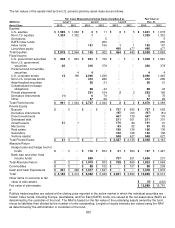

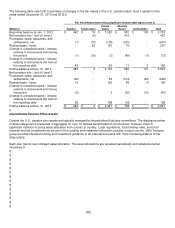

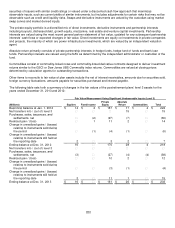

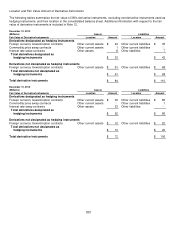

The following table sets forth a summary of changes in the fair values of the international pension plans’ level 3 assets for

the years ended December 31, 2013 and 2012:

Fair Value Measurement Using Significant Unobservable Inputs (Level 3)

Equities

Fixed Income

Private

Equity

Absolute

Return

Total (Millions)

Beginning balance at Jan. 1, 2012

$

5 $ 39

$

67 $ 370

$

481

Net transfers into / (out of) level 3

― ― ― ― ―

Foreign currency exchange

― 2 (4) 2 ―

Purchases, sales, issuances, and

settlements, net

― (2) 11 92 101

Realized gain / (loss)

― ― ― ― ―

Change in unrealized gains / (losses)

relating to instruments sold during

the period

― ― ― ― ―

Change in unrealized gains / (losses)

relating to instruments still held at

the reporting date

― (3) (3) 21 15

Ending balance at Dec. 31, 2012

5 36 71 485 597

Net transfers into / (out of) level 3

― ― ― ― ―

Foreign currency exchange

― (2) (1) 9 6

Purchases, sales, issuances, and

settlements, net

― (2) 1 50 49

Realized gain / (loss)

― ― 2 ― 2

Change in unrealized gains / (losses)

relating to instruments sold during

the period

― ― ― 1 1

Change in unrealized gains / (losses)

relating to instruments still held at

the reporting date

― 5 2 5 12

Ending balance at Dec. 31, 2013

$

5 $ 37

$

75 $ 550

$

667

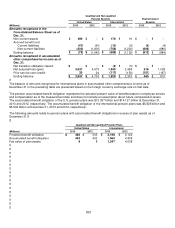

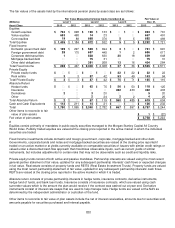

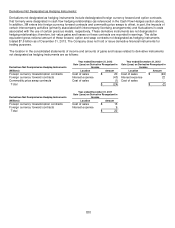

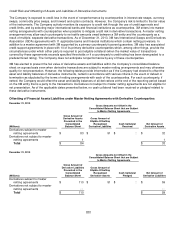

Postretirement Benefit Plans Assets

In order to achieve the investment objectives in the U.S. postretirement plan, the investment policy includes a target

strategic asset allocation. The investment policy allows some tolerance around the target in recognition that market

fluctuations and illiquidity of some investments may cause the allocation to a specific asset class to stray from the target

allocation, potentially for long periods of time. Acceptable ranges have been designed to allow for deviation from long-

term targets and to allow for the opportunity for tactical over- and under-weights. The portfolio will normally be rebalanced

when the quarter-end asset allocation deviates from acceptable ranges. The allocation is reviewed regularly by the named

fiduciary of the plan.